Exness Pro Accounts

Exness offers professional accounts for experienced traders who want to access advanced trading features. These accounts come with better spreads, higher leverage, and access to more trading instruments. Exness pro accounts are designed to cater to traders who require optimal conditions for large-volume and high-frequency trading. If you’re looking for a more flexible and powerful trading experience, the professional account might be the right option for you.

What is an Exness Professional Account?

The Exness Professional Account is for the professional trader looking for more advanced trading conditions. It allows access to better spreads, higher leverage, and more, which best suites the client who requires flexibility in their trading approach. It would be quite apt for professional accounts meant for volume traders or those favoring scalping and high-frequency trading.

Exness offers three popular types of professional accounts, namely Raw Spread, Zero, and Pro. For a trader, each type offers different conditions: the super-small spread in the Raw Spread account is great for clients who want to save money on trading; the zero spread in the Zero account includes a higher commission fee, though. More efficient execution and more control over your trades are key factors toward their popularity among professionals.

Types of Exness Professional Accounts

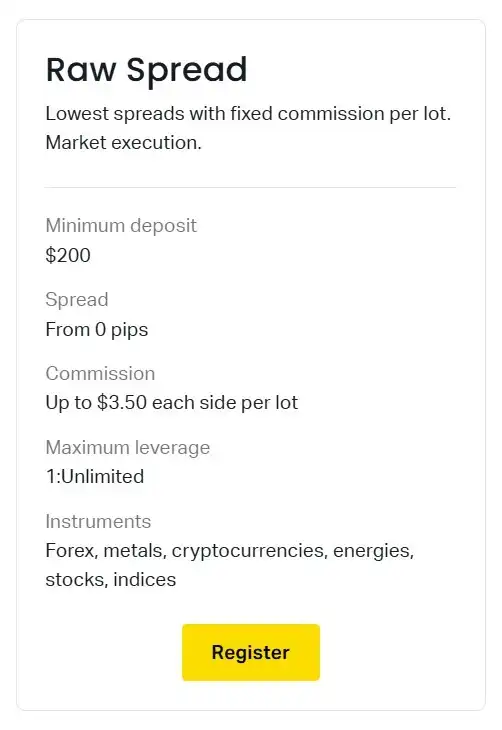

Exness Raw Spread Account

The Exness Raw Spread Account is great for traders who require the tightest spreads possible, as it provides access to raw market spreads. The account is designed for traders using scalping or high-frequency strategies. The low commissions and fast order execution make it ideal for active traders looking to maximize their profit margins by minimizing costs.

| Feature | Details |

|---|---|

| Spread Type | Raw spreads with a commission fee |

| Commission | Yes, based on trading volume, commissions vary |

| Leverage | Up to 1:2000 |

| Account Currency | USD, EUR, GBP, and more |

| Ideal For | Scalping, day trading, and high-frequency trading |

| Minimum Deposit | $200 |

| Order Execution | Market execution with low latency |

| Trading Platform | MetaTrader 4, MetaTrader 5, and Exness Web Terminal |

| Instruments Available | Forex, commodities, indices, stocks, and cryptocurrencies |

| Maximum Position Size | 100 lots per order |

| Hedging | Allowed |

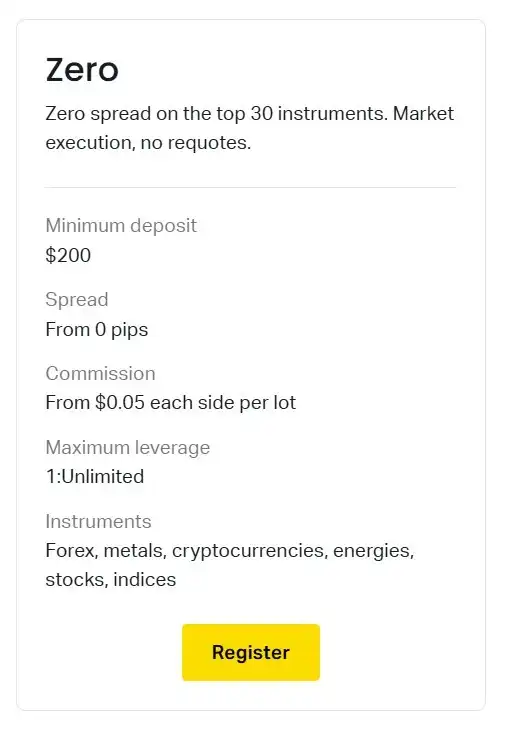

Exness Zero Account

The Exness Zero Account provides zero spreads on major pairs, allowing for highly cost-efficient trading. Instead of paying a spread, traders pay a small commission depending on the trading volume. This account is perfect for professional traders who rely on scalping or other strategies requiring the lowest trading costs. Fast execution and access to various instruments make this account suitable for a wide range of trading strategies.

| Feature | Details |

|---|---|

| Spread Type | Zero spread on major currency pairs |

| Commission | Yes, depending on volume, charged per side |

| Leverage | Up to 1:2000 |

| Account Currency | USD, EUR, GBP, and more |

| Ideal For | Professional and high-frequency traders |

| Minimum Deposit | $200 |

| Order Execution | Instant execution |

| Trading Platform | MetaTrader 4, MetaTrader 5, and Exness Web Terminal |

| Instruments Available | Major currency pairs, commodities, indices, and cryptocurrencies |

| Maximum Position Size | 100 lots per order |

| Hedging | Allowed |

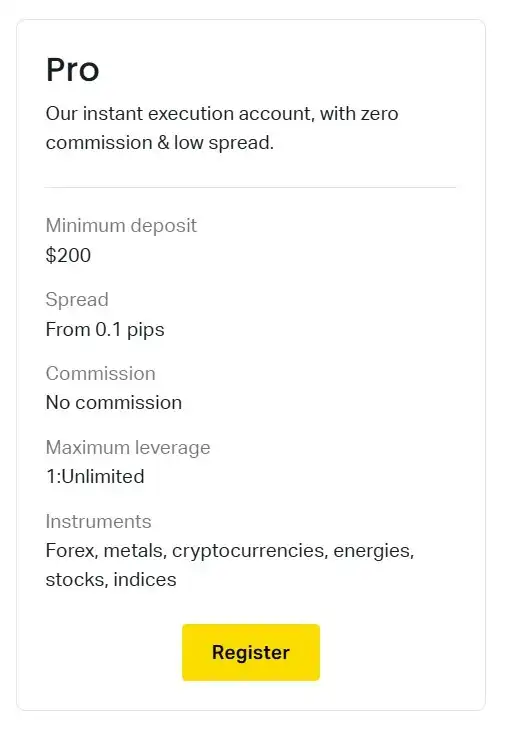

Exness Pro Account

The Exness Pro Account is designed for professional traders who need both fixed and variable spreads, providing greater flexibility depending on market conditions. It comes with competitive commissions and high leverage, making it suitable for traders who require stable and reliable conditions for larger positions. The account also allows a range of instruments to be traded, and its transparency ensures professional-level control over costs and spreads.

| Feature | Details |

|---|---|

| Spread Type | Fixed and variable spreads, depending on market conditions |

| Commission | Variable, based on the trading volume |

| Leverage | Up to 1:2000 |

| Account Currency | USD, EUR, GBP, and more |

| Ideal For | Traders seeking stability and flexibility in their trades |

| Minimum Deposit | $500 |

| Order Execution | Market execution with competitive spread and quick fills |

| Trading Platform | MetaTrader 4, MetaTrader 5, and Exness Web Terminal |

| Instruments Available | Forex, commodities, indices, stocks, cryptocurrencies, and ETFs |

| Maximum Position Size | 100 lots per order |

| Hedging | Allowed |

How to Open an Exness Professional Account

To open an Exness Professional Account, follow these steps:

- Visit the Exness website or download the mobile app.

- Click on “Sign Up” and enter your email address and personal details.

- Select “Professional Account” as your account type.

- Set a secure password for your account.

- Complete the registration process and verify your email address.

- Submit the required documents for account verification, including an ID and proof of address.

- Once verified, fund your account and begin trading.

Opening an Exness Professional Account is quick and straightforward. After registration, ensure that your account is verified with the necessary documents. Once your account is approved, you’ll have access to advanced trading features, higher leverage, and tighter spreads, making it suitable for experienced traders.

Account Verification Requirements

Verification if your Exness Professional Account requires two main documents: a government-issued ID, such as a passport, national ID, or driver’s license, and a document proving your address, such as a utility bill, bank statement, or tax document. This proof of address should be no older than 3 months and include your full name and address. This verification ensures your account is secure and complies with financial regulations. It usually takes 1-2 business days. If for some reason there is an issue with your documents, Exness support will be able to help you resolve it as soon as possible to make your account completely active.

Trading Strategies Best Suited for Pro Accounts

Exness Pro Accounts offer advanced features that are ideal for experienced traders. Here are some strategies that work well with Pro accounts:

-

Scalping: Taking advantage of small price movements over short time periods.

Scalping: Taking advantage of small price movements over short time periods.

-

Day Trading: Opening and closing trades within the same trading day.

Day Trading: Opening and closing trades within the same trading day.

-

Swing Trading: Capturing price swings over several days or weeks.

Swing Trading: Capturing price swings over several days or weeks.

-

Carry Trading: Profiting from the difference in interest rates between two currencies.

Carry Trading: Profiting from the difference in interest rates between two currencies.

-

News Trading: Capitalizing on price volatility during major economic events.

News Trading: Capitalizing on price volatility during major economic events.

These strategies are best utilized with Pro accounts since these accounts have access to tight spreads, high leverage, and advanced trading tools. The Pro account is designed for traders comfortable with market volatility and in need of quicker execution speed to implement their strategies efficiently. Be it the application of scalping techniques or trading on key news events, the flexibility and features of a Pro account will maximize your trading potential.

Key Differences Between Pro and Standard Accounts

Exness offers both Pro and Standard accounts, each designed to cater to different types of traders. Below are the main differences:

| Feature | Pro Account | Standard Account |

|---|---|---|

| Spreads and Commissions | Tighter spreads, lower commissions, ideal for high-frequency traders | Slightly higher spreads, no commissions, suitable for casual traders or beginners |

| Leverage | Higher leverage options, control larger positions with smaller capital | Limited leverage, better for less risk |

| Execution Speed | Faster execution, suitable for scalping and high-speed strategies | Slower execution, suitable for longer-term trades |

| Account Types | Specialized types: Raw Spread, Zero accounts, ideal for professional traders | Basic types: Standard, Standard Cent accounts, beginner-friendly |

| Minimum Deposit | Higher minimum deposit, reflects advanced tools and features | Lower minimum deposit, accessible for new traders |

The traders who look for low spreads, fast execution, and higher leverage prefer the Pro account. On the other hand, traders who are new to the market or prefer a more straightforward trading experience with fewer complexities often opt for the Standard account. The Pro account is best suited for professional traders looking to take advantage of advanced features, while the Standard account is more beginner-friendly and ideal for casual trading.

How to Choose the Right Exness Pro Account for Your Trading Style

Choosing the right Exness Pro account depends on your trading goals, experience, and preferred strategy. Each type of Pro account offers unique benefits that align with different styles of trading. Here’s how to make the right choice:

- Exness Raw Spread Account: Ideal for professional traders looking for the tightest spreads. If your strategy involves frequent trading or scalping, the Raw Spread account can offer the lowest possible cost per trade, with no mark-ups but a commission charge.

- Exness Zero Account: This account type is best suited for traders who want zero spreads on major currency pairs. However, it comes with a small commission per trade. It’s designed for traders who prioritize tight pricing on their trades over the cost of commissions.

- Exness Pro Account: Best for traders who need a balance between low spreads and commissions. This account is designed for experienced traders who need high liquidity and fast execution without the higher commissions of the Raw Spread account.

How to Choose:

- If you’re a Scalper or High-Frequency Trader: The Raw Spread Account is perfect due to the tightest spreads and low commissions, helping to minimize your trading costs.

- If you’re a Swing or Position Trader: A Pro Account could be more suitable, offering low spreads and good execution speed without excessive fees.

- If you want to trade major pairs with no spread: Choose the Zero Account for zero spreads, understanding there will be a commission charge per trade.

If you’re just starting out and still learning the ropes, you might find the Pro account more forgiving. For those focused on day trading and looking to minimize costs as much as possible, the Raw Spread or Zero accounts are best for you, depending on your preference for paying commissions in return for better pricing.

Risks Associated with Using a Professional Account

Operating an Exness Professional Account has a number of advantages but also carries its own risks. The main risks include increased exposure to market volatility, as these accounts are often utilized by advanced traders who make more and larger trades. Tight spreads and leverage in Pro accounts can increase profits and losses, so one should have a well-planned risk management strategy. Besides, while Pro accounts offer speedier execution and better liquidity, they may have higher margin requirements, which involve a need for more capital to keep positions open. Traders need to be quite attentive with their accounts and make sure that they apply proper risk management through tools like stop-loss orders in order to minimize their possible losses.

Exness Pro Account Deposit and Withdrawal Process

Exness Pro Account Deposit Process:

- Log in to Exness Personal Area: Go to the Exness website or mobile app and log into your Personal Area using your credentials.

- Navigate to the Deposit Section: Select the ‘Deposit’ option under the ‘Funds’ section of your account.

- Choose Your Payment Method: Pick the method that suits you best, such as bank transfer, credit/debit card, or e-wallet.

- Enter Deposit Amount: Specify how much you want to deposit into your Exness Pro account.

- Confirm Deposit: Complete the transaction by confirming the deposit details and following the instructions to finish the process.

After following these steps, your funds will appear in your trading account, ready for use in the market.

Exness Pro Account Withdrawal Process:

- Log in to Exness Personal Area: Open the Exness website or mobile app and sign in to your Personal Area.

- Go to Withdrawal Section: Choose the ‘Withdrawal’ option from your account dashboard.

- Select Withdrawal Method: Choose your preferred method for withdrawing funds, which can include bank transfers, e-wallets, or credit/debit cards.

- Enter the Withdrawal Amount: Specify the amount you wish to withdraw from your account.

- Complete the Withdrawal Request: Confirm the withdrawal details and follow the necessary steps to finish the transaction.

Once the withdrawal has been made, funds are transferred to your chosen method of payment. Remember, processing time is variable based on the kind of method used. Make sure you are aware of possible charges, withdrawal limits, and processing time for each one so that delays may be avoided. Also, one needs to ensure that payment information is up-to-date for seamless transactions.

Advantages of a Pro Account Compared to a Standard Account

Exness Pro accounts offer several benefits over standard accounts, making them an ideal choice for experienced traders looking for advanced features. Some of the key advantages include:

- Lower Spreads: Pro accounts typically offer much lower spreads compared to standard accounts. This allows traders to save money on each trade, particularly for high-volume or short-term trading strategies.

- Higher Leverage: Pro accounts often come with higher leverage, meaning traders can control larger positions with less capital. This can be beneficial for advanced traders who understand the risks and want to maximize their potential profits.

- Faster Execution: Pro accounts generally offer faster execution speeds, which is crucial for traders who rely on quick market movements and need to execute trades instantly.

- More Liquidity: With a Pro account, traders often benefit from better liquidity, especially for major currency pairs and popular instruments, which can improve trade execution and pricing.

- Advanced Trading Tools: Pro accounts typically provide access to advanced trading tools and charting features, allowing traders to analyze the markets in greater detail and make informed decisions.

- No Restrictions on Trading Styles: Professional accounts offer more flexibility, allowing traders to use different strategies such as scalping, hedging, or automated trading systems without restrictions, unlike some standard accounts.

Conclusion

The Pro account is ideal for professional traders seeking reduced costs, sophisticated tools, and expanded trading capabilities. Though they demand more capital and knowledge, the benefits in speed, liquidity, and lowered costs can be very enriching for your trade. However, one should not forget the risks that come along, especially with high leverage, and that one needs to have appropriate risk management.

FAQs about Exness Pro Accounts

What is a Pro account on Exness?

The Pro account on Exness is designed for more experienced traders who require competitive spreads without any commissions. It offers a minimum deposit of $200, leverage up to 1:Unlimited, and access to a wide range of trading instruments, including forex, metals, cryptocurrencies, and stocks. This account type is ideal for traders looking for flexible trading conditions without added commission costs.

Which account is best in Exness?

The best Exness account depends on your trading style. For beginners, the Standard Cent Account is a good choice, offering low minimum deposits and the ability to trade micro-lots. If you’re an experienced trader, the Raw Spread Account or Zero Account might be more suitable, as they offer tight spreads and lower commissions, making them ideal for scalping or high-frequency trading.

How many Exness accounts can I have?

Exness allows traders to have multiple accounts, including live, demo, and professional accounts. This gives you the flexibility to manage various strategies or trade different instruments across separate accounts. However, you will need to ensure that all accounts are properly verified and in good standing with Exness.

Is there a limit on Exness accounts?

There is no fixed limit on the number of Exness accounts you can open. However, each account must meet Exness’s verification requirements, and all must be managed according to their terms and conditions. It’s important to keep track of your accounts and ensure compliance with Exness guidelines.

How do I change my Exness account type?

You cannot directly change the account type once it’s been created. However, you can open a new account with a different type through your Exness Personal Area. You’ll need to meet the minimum deposit requirements for the new account and ensure that your verification details are up to date.

Can I have both a demo and a live account with Exness?

Yes, Exness allows you to have both demo and live accounts simultaneously. This enables you to practice trading in a risk-free environment while managing your live trading account. It’s a useful way to refine strategies before implementing them with real funds.