Exness Calculator

The Exness Calculator stands as a cornerstone of the Exness trading platform, serving as a comprehensive tool aimed at bolstering the efficacy and strategic depth of traders’ operations. This calculator is designed not just as a utility for calculating potential outcomes but as a multifaceted instrument that enriches the entire trading experience through detailed insights and analyses.

Table of Contents ⇓

What is the Exness Calculator?

The Exness Calculator is a multifunctional tool crafted to provide traders with precise calculations relevant to their trading activities. It encompasses a wide array of functionalities, including but not limited to:

- Profit/Loss Estimations: It calculates potential profits and losses for trades based on current market conditions, helping traders gauge the viability of their strategies.

- Margin Requirements: The calculator determines the necessary margin to hold open positions, which is crucial for managing leverage and capital allocation.

- Additional Calculations: Beyond profits and margin, it also offers calculations on pip value, swap fees, and commission costs, all tailored to the individual’s trading parameters.

Advantages of the Exness Profit Calculator

The Exness Profit Calculator brings several key advantages to the trading table, making it an invaluable asset for traders aiming to optimize their strategies and manage risks more effectively. These benefits include:

- Instantaneous Calculations: It provides real-time calculations on potential outcomes, allowing traders to make quick, informed decisions.

- Risk Management Assistance: By offering insights into possible losses and required margins, the calculator helps traders adjust their strategies to better manage risk.

- Strategic Planning Support: With the ability to project future profits and assess various trading scenarios, traders can plan their investments more strategically.

- User-Friendly Interface: Designed with the user in mind, the calculator simplifies complex trading calculations, making it accessible to both novice and experienced traders.

- Comprehensive Analysis: It goes beyond basic calculations by incorporating various trading factors into its analyses, offering a holistic view of potential trade outcomes.

Step-by-Step Guide to Using Exness Calculator

When using the Exness Calculator, traders input specific trade details to unlock a comprehensive analysis, pivotal for meticulously planning trades and assessing potential outcomes prior to execution. This depth of analysis ensures traders are equipped with the necessary insights to navigate the complexities of the financial markets effectively.

Here’s a comprehensive guide to help you maximize its potential:

- Start by logging into your Exness account. Navigate to the “Tools” section on the dashboard, where you’ll find the Exness Calculator ready for use.

- Depending on your trading needs, choose the specific calculator you wish to use. The Exness platform offers various calculators, including those for profit/loss, margin, pip value, and swap fees.

- Enter the specifics of your trade, including account type, currency, trading instrument, lot size, and leverage. This precision helps tailor the calculation to your exact trading scenario.

- Review the calculated outcomes, such as required margin, spread cost, potential commission, swap fees, and the pip value. These insights are crucial for understanding the financial implications of your proposed trade.

- Use the insights gained from the calculator to adjust your trading parameters. Experiment with different lot sizes, leverage, and instruments to see how these changes might affect your potential outcomes.

- Once you’re satisfied with the calculated scenario and have a solid understanding of the potential risks and rewards, you can proceed to apply this strategy to your live trading activities.

- Regularly use the Exness Calculator before executing trades to become more proficient in predicting outcomes and managing risks. Over time, this will help refine your trading strategies for better success rates.

Explain Input Parameters

The Exness Calculator requires traders to specify several key parameters to tailor its output to their specific trading scenarios, enhancing the relevance and accuracy of its calculations.

Account Type:

This input dictates the trading conditions that will apply, including the leverage options and spread sizes available to the trader. Different account types offer varying conditions, which can significantly influence the profitability and risk level of trades.

Account Currency:

Essential for ensuring that the calculated outcomes are presented in a currency that the trader can easily interpret and relate to their account balance. This conversion is crucial for a clear understanding of the financial impact of trades.

Instrument:

The choice of trading instrument is critical, as each has unique characteristics that affect calculation parameters such as pip value and margin requirements. Selecting the correct instrument ensures that the calculator’s output accurately reflects the potential outcomes of trades in that specific market.

Lot Size:

Represents the volume of the trade and is directly correlated with the potential profit or loss that can be realized. The lot size is a key determinant of trade size and impacts the amount of capital at risk.

Leverage:

By adjusting the leverage, traders can control the size of the position relative to their investment capital. Leverage is a powerful tool that can amplify both potential returns and losses, making it a critical factor in risk management and capital allocation strategies.

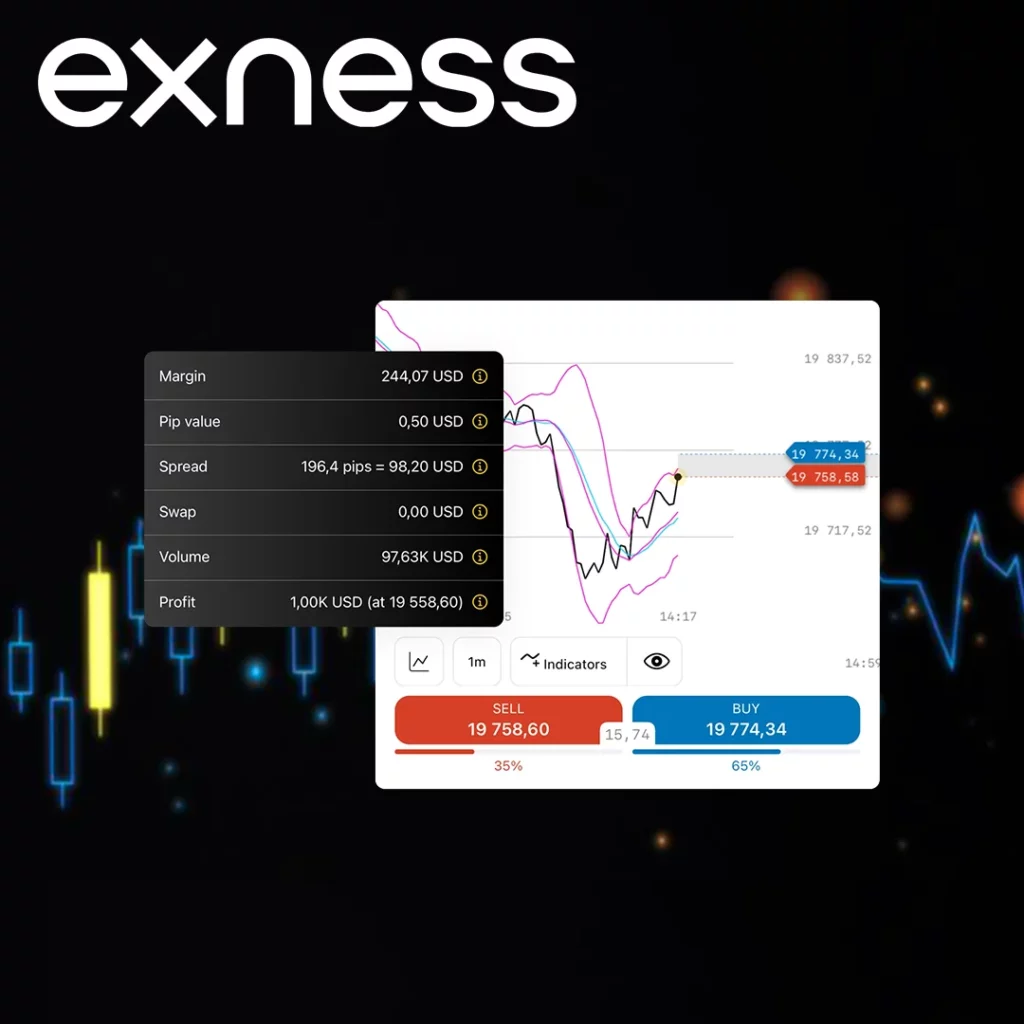

Explain Results

The calculator’s output offers crucial insights into various financial aspects of the planned trade, including both direct costs and potential earnings.

Margin:

Indicates the amount of capital required to open and maintain the position, serving as a key budgeting tool for traders. Understanding margin requirements is essential for effective capital management.

Spread Cost:

Represents the difference in cost between the buy and sell price at the time of trade entry. This cost directly affects the initial expense of entering a trade and can impact overall profitability.

Commission:

Any broker fees charged for executing the trade are detailed here. Commissions are an important consideration when calculating the net profit or loss of a trade.

Swap Short:

Swap short reflects interest paid or received for overnight short positions, determined by the interest rate difference between traded currencies. Positive if the sold currency’s rate is higher, it impacts trade profitability.

Swap Long:

Swap long applies to overnight long positions, with interest influenced by the currency rates involved. Earning occurs if the bought currency’s rate surpasses the sold, affecting trade outcomes.

Pip Value:

This shows the value of a one-pip movement in the trading instrument relative to the account currency. Understanding pip value is crucial for assessing the potential impact of market movements on the trade.

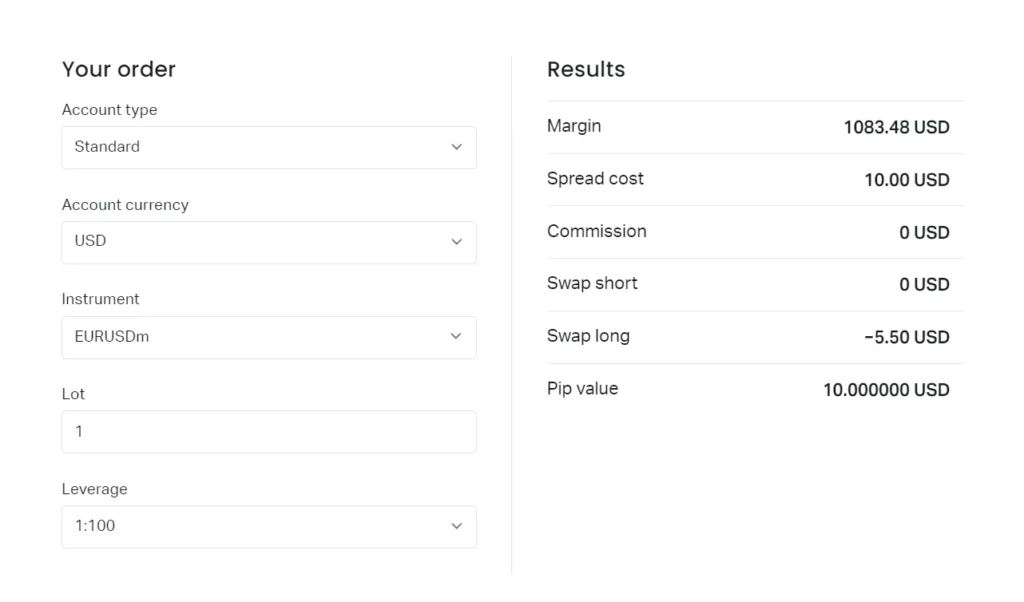

Example of Using Exness Trading Calculator

Imagine a trader planning to open a long position on the EUR/USD currency pair with the following parameters:

- Account Type: Standard

- Account Currency: USD

- Instrument: EUR/USD

- Lot Size: 1 lot (100,000 units)

- Leverage: 1:100

After inputting these details into the Exness Calculator, the trader reviews the calculated outcomes:

| Results | Explanation |

| Margin: 1083.48 USD | This figure represents the amount of capital required to open and maintain the position. It’s calculated based on the leverage used and the total value of the trade, ensuring the trader has enough funds to cover potential losses. |

| Spread cost: 10.00 USD | Spread cost is the difference between the buy and sell price at the time of trade execution. A $10 spread cost means that this amount is paid upfront as a trading cost, affecting the initial profitability of the trade. |

| Commission: 0 USD | This indicates that no brokerage fee is charged for executing this particular trade. Some trades may incur a commission, but in this case, the trade is commission-free, reducing overall trading costs. |

| Swap short: 0 USD | Swap fees are interest payments for holding a position overnight. Since this is a short swap, it indicates no interest is charged or paid for holding a short position overnight in this scenario. |

| Swap long: −5.50 USD | For holding a long position overnight, a swap fee of $5.50 is charged. This fee is deducted from the trade’s profitability and is important to consider for trades held for more than a day. |

| Pip value: 10.000000 USD | Pip value indicates how much a single pip movement in the currency pair’s price would affect the trade’s value. Here, each pip movement is worth $10 to the trade, meaning a 1 pip increase or decrease in the EUR/USD pair would result in a $10 gain or loss, respectively. |

Advanced Features of Exness Calculator

The calculator goes beyond simple profit and loss estimations, embedding features that cater to sophisticated risk management strategies, allow for extensive customization to match individual trading preferences, and ensure seamless integration with trading platforms. These features collectively empower traders to navigate the markets with greater confidence and precision.

Advanced Risk Management

This feature of the Exness Calculator provides traders with the ability to meticulously manage their exposure to risk. By enabling the adjustment of risk parameters such as stop-loss levels and take-profit points, traders can craft strategies that align with their risk tolerance, ensuring that they can safeguard their capital more effectively.

Customization Options

Understanding that no two traders are the same, the Exness Calculator offers extensive customization options. Traders can modify inputs based on their unique trading conditions, preferences, and strategies. This level of customization ensures that the calculator’s outputs are not just generic estimations but tailored insights that can directly influence trading decisions.

Integration with Trading Platforms

One of the standout features of the Exness Calculator is its ability to integrate directly with trading platforms. This means that traders can apply the insights gained from their calculations directly into their trading actions without the need for manual data transfer. Such integration streamlines the trading process, making it more efficient and less prone to errors.

Conclusion

The Exness Calculator transcends being merely a tool for calculations; it is a strategic partner in trading. By offering detailed analyses, risk management capabilities, customization options, and seamless platform integration, it provides traders with the essential data and functionalities needed for informed decision-making and strategic planning. Whether for novice traders seeking to understand the basics or experienced market players optimizing complex strategies, the Exness Calculator is a fundamental component of a successful trading approach.

Exness Calculator: FAQs

How do you use the Exness Forex calculator for trading operations?

Enter details like the chosen instrument, lot size, and leverage into the Forex calculator. It will then provide potential profit or loss estimates, aiding in informed trading decisions.

How can traders optimize their trading with the Exness Leverage Calculator?

Traders can adjust leverage levels using the Exness Leverage Calculator to explore various risk-reward scenarios, enabling them to find an optimal balance that suits their trading strategy and risk tolerance.

What features does the Exness Trading Calculator offer, and how do traders benefit from them?

The Exness Trading Calculator provides insights into potential trading costs and outcomes, including profit/loss estimations. This aids in risk management and helps traders in strategic planning, enhancing their trading effectiveness.

How is the required margin calculated using the Exness Margin Calculator?

To calculate the required margin with the Exness Margin Calculator, input your trade size, leverage, and chosen instrument. The calculator will then determine the necessary margin to open and maintain your position, ensuring proper risk management.

What tools does the Exness Tools Calculator provide for traders?

The Exness Tools Calculator offers a suite of calculators, including those for profit/loss, margin, and pip value, among others. These tools assist traders in making well-informed decisions by providing detailed analyses of potential trade outcomes.