Exness Islamic Account

This account option allows Muslim traders to participate in financial markets without conflicting with Islamic principles.

What is an Exness Islamic Account?

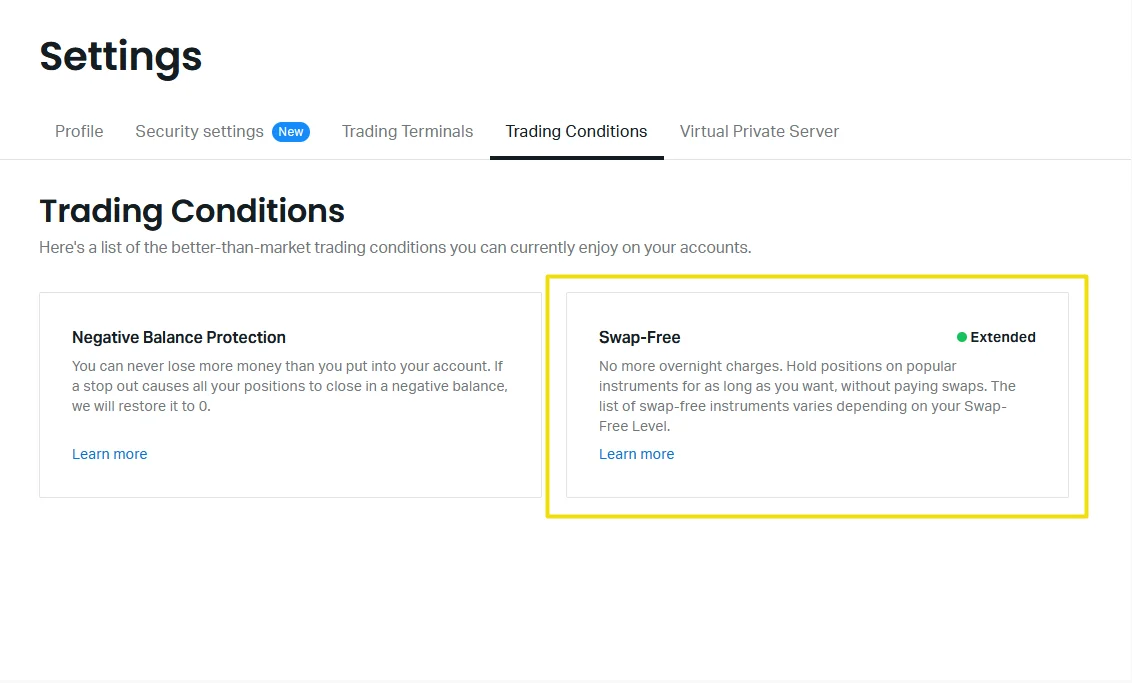

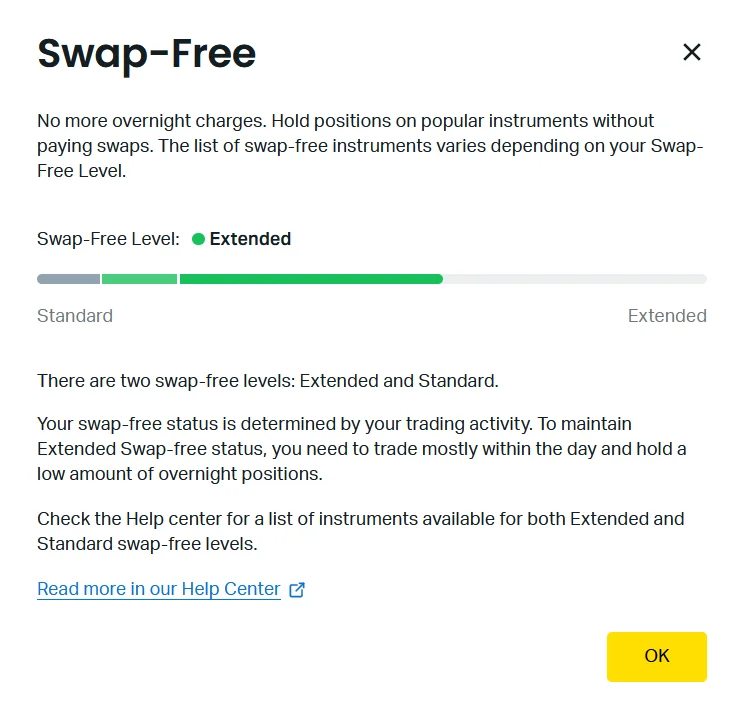

An Exness Islamic Account caters specifically to Muslim traders who prioritize following Sharia law in their financial activities. Sharia law prohibits riba, a term encompassing usury and interest-based charges. Traditional trading accounts might incur swap fees on positions held overnight, which can be seen as a form of riba.

Exness Islamic Accounts address this concern by eliminating swap fees entirely. This ensures your trading aligns with your religious beliefs and allows you to focus on your strategies without worrying about accumulating overnight interest charges.

| Feature | Description |

| 💸 Swap-Free Trading | No interest charges on positions held overnight |

| 🕌 Sharia-compliant | Follows Islamic principles |

How to Open an Exness Islamic Account

Opening an Islamic account with Exness is easy and straightforward, even for complete beginners. Just follow these simple steps:

Step 1: Visit the Exness Website

Head over to the official Exness website. You can find it with a quick internet search for “Exness.”

Step 2: Open an Account

Look for the “Open Account” button, usually located prominently on the homepage. Clicking it will initiate the account creation process.

Step 3: Fill Out the Registration Form

The form will ask for basic information like your name, email address, and desired account currency. Make sure to choose the currency you’d like to trade in.

Step 4: Select Your Account Type

During registration, you’ll be presented with various account options. Be sure to choose the “Islamic Account” option to ensure swap-free trading.

Step 5: Verify Your Identity

Exness requires identity verification for security purposes. This usually involves uploading scans of your passport or government-issued ID and proof of address (like a utility bill).

Step 6: Fund Your Account

Once verified, you can deposit funds into your new Islamic account using various payment methods offered by Exness. Popular options include debit/credit cards, bank transfers, and e-wallets.

Step 7: Start Trading!

After completing these steps and your account is funded, you’re ready to explore the Sharia-compliant instruments available on Exness and begin your trading journey!

Commissions and Spreads on an Exness Islamic Account

While Exness Islamic Accounts eliminate swap fees, there are still costs associated with your trades. Let’s break down the two main factors impacting your trading costs:

1. Commissions:

- Some Exness Islamic Account types may have commissions applied per trade. These are typically a fixed amount charged on both opening and closing a position.

- Other Islamic Account types might offer commission-free trading. Be sure to check the specific details of your chosen account type during registration.

2. Spreads:

- Spreads represent the difference between the buy and sell price of a financial instrument. This is the gap you need to overcome to make a profit on your trade.

- Exness Islamic Accounts typically offer variable spreads, meaning the spread can fluctuate based on market conditions.

- Exness offers several Islamic Account types with varying minimum spreads. Research and choose the account that aligns with your trading style and preferred spread range.

Here’s a quick tip:

Compare the commission structure and typical spread ranges of different Exness Islamic Account types before opening one. This will help you choose the account that best suits your trading needs and minimizes your overall trading costs.

Available Sharia-Compliant Instruments

With your Exness Islamic account, you can trade several different financial instruments that follow Islamic principles.

The main instruments available are:

Forex Currency Pairs

- This includes major currency pairs like EUR/USD, GBP/USD, USD/JPY

- As well as cross-currency pairs like EUR/GBP, AUD/NZD

Precious Metals

- You can trade gold and silver

- These are physical commodities allowed under Sharia law

Cash Indices

- Indices track major global stock markets like the S&P 500, FTSE 100, Germany 30

- Trading indices avoids direct investment in companies

All of these instruments have been carefully selected to ensure they comply with Sharia rules against interest (riba), excessive risk (gharar), and involvement in non-permissible activities.

You can trade these instruments through the Exness platforms and take advantage of the swap-free Islamic account conditions.

Your account follows the principles of Islamic finance, so you can trade with confidence knowing everything is Halal and adheres to Islamic laws.