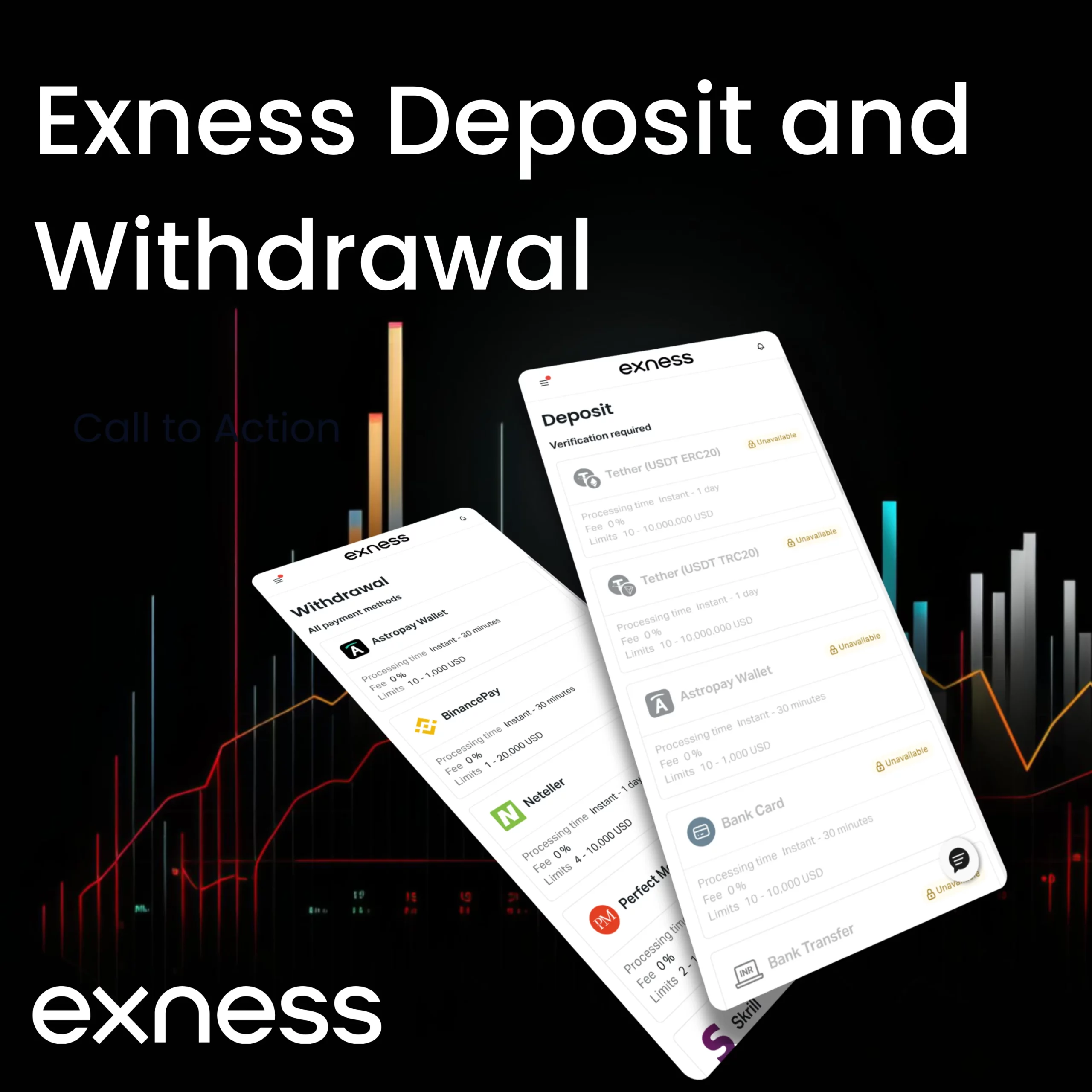

Exness Deposit and Withdrawal

Exness is a very popular online broker with over 600,000 active traders. It is properly regulated by authorities like the FCA and CySEC. Exness offers many tradable assets such as currencies, metals, energy products, and cryptocurrencies.

For traders, both new and experienced, it’s crucial to understand how to deposit and withdraw money from your trading account smoothly. This review will explain the different deposit and withdrawal methods available at Exness. It will also cover how long these processes typically take and provide tips to help you avoid withdrawal issues, including potential Exness withdrawal problems, and get your funds quicker.

While Exness makes it easy to fund your account, being aware of any difficulties withdrawing profits is important. With fast and secure transactions when things go right, Exness aims to ensure a smooth trading experience from start to finish for both novice and seasoned traders to manage their trading finances effectively.

Exness Payment Methods

Exness offers various deposit methods to fund trading accounts, each with specific minimum deposit limits and processing times. The available deposit options include:

- Bank Transfer

- Webmoney

- Wire Transfer

- Credit/Debit Cards

- Perfect Money

- Skrill

- Neteller

The availability of deposit methods may vary by country. Traders should check the supported options in their region within the Personal Area, which may also indicate any restrictions on certain methods.

Base Currencies at Exness

Exness accommodates a variety of base currencies, contingent upon the type of trading account selected. For a standard account, traders can utilize the following currencies:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

Traders must select the appropriate base currency when setting up their trading account, as this choice cannot be changed later. Depositing funds in a different currency will incur conversion charges. To manage multiple base currencies, traders can open additional Exness trading accounts within the same Personal Area, allowing for strategic currency selection and minimizing conversion fees.

Making Deposits on Exness

Exness provides multiple deposit options to suit various preferences. Available methods include:

- Credit/Debit Cards

Exness accepts major card networks globally. Provide your card details and deposit amount. Note that your bank may charge transaction fees.

- Direct Bank Transfers

Fund your account through wire or direct bank transfers. Obtain Exness account details, then initiate the transfer from your bank’s online portal or in-person. Deposits typically reflect within 72 hours, without fees, and with high deposit limits.

- E-wallets

Link digital wallets like Skrill, Neteller, and Perfect Money for instant deposits. However, some traders may have concerns about involving third-party providers.

To initiate a deposit on Exness, follow these simple steps:

- Log into your Exness account’s personal area on the official site or app.

- Click on “Deposit” in the side menu.

- Choose your preferred payment method (credit cards, bank transfers, e-wallets, or cryptocurrencies).

- Enter your Exness account number, chosen base currency, and the deposit amount. Click “Next.”

- Confirm your payment details.

- Follow the instructions on your screen for payment confirmation through your selected payment provider. Once completed, funds will reflect in your account.

Remember, Exness only permits deposits from payment methods registered under your name to ensure seamless withdrawals and prevent disputes.

Exness Deposit Limits and Associated Fees

Deposit limits and potential fees vary based on account type and selected payment method. Standard trading accounts may have a $1 minimum deposit, while professional accounts may require a $200 minimum. Specific payment methods also entail varying minimum deposit amounts:

- Credit/Debit Cards: $3 USD

- PerfectMoney: $2 USD

- Skrill: $10 USD

- Neteller: $10 USD

- Internal Transfer: $1 USD

Exness typically doesn’t charge fees for funding your trading account, but transaction fees from your chosen payment provider may apply. The processing time varies based on the selected payment system, with most systems providing instant fund transfers upon confirmation.

Problems and Solutions for Exness Deposits

Common Exness Deposit Issues

- Payment method unavailability in certain regions.

- Failed deposits due to technical issues or incorrect details.

- Longer than expected processing times.

- Payment method verification requirements.

- Rejected third-party payment methods.

- Delays with cryptocurrency deposits.

Solutions

- Check supported payment methods in your Personal Area.

- Contact Support with transaction ID for failed deposits.

- Provide requested documents for payment verification.

- Only use payment methods registered in your name.

- Monitor blockchain for crypto deposit confirmations.

If you encounter any deposit-related issues or have specific questions, Exness recommends contacting their Support Team promptly. Provide detailed information, including your account details, transaction IDs, and any relevant documentation, to facilitate a swift resolution.

Exness Deposit Bonus

Exness, in line with its core values, does not offer deposit bonuses. Instead, traders can explore earning opportunities through partnership programs, where introducing new traders to Exness can yield revenue shares or affiliate program earnings of up to $1850 per client.

Withdrawing Funds from Exness

Just as deposits are crucial, withdrawals play an equally vital role in online trading, allowing traders to access their funds seamlessly. Exness offers a range of withdrawal options, catering to diverse preferences:

- Bank Cards:

Withdraw funds directly to your Visa, Mastercard, or other credit/debit cards. While withdrawal restrictions and potential bank fees may apply, these transactions are typically processed within one business day.

- Bank Transfers:

Request direct fund transfers by providing Exness with your bank details. Most banks facilitate these withdrawals within 1-3 business days, and Exness does not charge any fees.

- E-wallets:

E-wallet integration, including Skrill and Neteller, facilitates instant withdrawals, granting access to your funds within minutes. However, third-party transaction fees may apply in certain cases.

To initiate a withdrawal, follow these simple steps:

- Visit the official site and log into your Exness account’s Personal Area.

- Select the “Withdrawal” option from the left side menu.

- Choose your preferred payment method.

- Enter your Exness account details, currency, and withdrawal amount. Click “Next.”

- Verify withdrawal details, enter the SMS code received, and confirm your payment.

- Provide the necessary credentials for the target payment account to complete the transaction.

Skrill Withdrawals at Exness

- Skrill is an accepted withdrawal method at Exness.

- Withdrawals to Skrill e-wallets are typically instant once processed.

- To withdraw to Skrill, you must have previously made a deposit from your Skrill account.

- In your Exness account, go to the “Withdrawal” section and select Skrill as the withdrawal method.

- Enter the amount you want to withdraw and your Skrill email address associated with the account.

- Exness does not charge any fees for Skrill withdrawals, but Skrill itself may have third-party transaction fees.

- Your Skrill account name must match the name on your verified Exness trading account.

- Skrill withdrawals are available to fully verified Exness account holders only.

The withdrawal will be instantly credited to your Skrill account once processed and approved by Exness. Contact support if you have any issues withdrawing to your Skrill e-wallet.

Withdrawal Times at Exness

The processing time for withdrawals varies based on the chosen method:

- Bank transfers: 1-7 days.

- E-wallets and bank cards: Instant – 24 hours.

- Cryptocurrency: up to 24 hours.

Limits and Fees for Exness Withdrawals

Exness maintains policies about withdrawal restrictions and fees in order to guarantee fairness and openness in its operations:

- Exness does not charge withdrawal fees, but third-party payment processors may impose their charges.

- Minimum withdrawal limits range from $1 for most methods to $50 for direct bank transfers.

- Exness reserves the right to decline withdrawal requests not complying with its policies.

Exness Withdrawal Problems

While Exness endeavors to streamline the withdrawal process, traders may encounter specific challenges:

- Incorrect Withdrawal Details:

Delays in processing may result from the entry of inaccurate or insufficient data. Before submitting withdrawal requests, it is recommended that traders thoroughly examine the payment information.

- Incomplete Account Verification:

Withdrawal limitations may be imposed on unverified accounts as a result of Exness’s rigorous Know Your Customer (KYC) and anti-money laundering protocols. Valid identification documents are required to complete the verification procedure in order to prevent any potential delays.

- Non-Matching Payment Methods:

Withdrawals from Exness are generally processed through the identical method employed for deposits. Alternative approaches may be met with disfavour.

- Technical Issues:

While rare, technical problems can occur. If you encounter any, reach out to Exness support through the Exness Mobile App or other channels.

Exness Transaction Security Measures

Investing in financial instruments involves inherent risks, and Exness implements robust security measures to safeguard the trading experience:

- Robust Account Security: Exness employs a two-step approach, combining robust data encryption to secure personal information and a two-factor authentication system for added account security.

- Segregated Client Accounts: Traders’ funds are secured through segregated client accounts, ensuring a clear separation from the company’s funds and reducing the risk of misuse.

- KYC Compliance: Exness strictly adheres to Know Your Customer (KYC) requirements, necessitating the submission of documents for identity verification. This helps prevent money laundering, fraud, and illegal activities.

Smooth Transaction Tips for Exness

To enhance the user experience during deposits and withdrawals, consider the following practical tips:

- Prompt Account Verification: Verify your account promptly by providing relevant identification documents to avoid any restrictions on deposits or withdrawals.

- Consistent Payment Method: Use the same payment method for all transactions to avoid potential issues when receiving funds.

- Monitor Account Balance: Keep track of your account balance to ensure sufficient funds are available before initiating a withdrawal request.

- Verify Banking Details: Counter-check banking details during both deposits and withdrawals to prevent delays or processing errors.

- Contact Customer Support: In case of technical issues, reach out to the 24/7 customer support team for assistance. Provide your support PIN and account number for swift resolution.