Exness Calculator

The Exness Calculator is a key tool on the Exness platform. This calculator helps traders make better choices. It can figure out profits, check risks, and set trade sizes. Traders use it for Forex, crypto, and other markets. The tool is free for all account holders. It works on both computers and phones. The creators update the calculator often, adding new features based on what users say they want. Traders can use it to plan their trades more effectively.

What is the Exness Calculator?

The Exness Calculator helps traders do math for their trades. It can do many things:

- Profit and Loss Math: The calculator shows how much money a trade might make or lose. This helps traders see if their plan is good.

- Margin Checks: It figures out how much money traders need to keep trades open. This is important for using borrowed money safely.

- Other Sums: The calculator also works out pip values, swap costs, and fees. It uses the trader’s own numbers for this.

Advantages of the Exness Profit Calculator

Exness Profit Calculator helps traders. Traders use the Exness calculator to trade better. It works for Forex and other markets. The tool is free for Exness users. It has many other good points:

- Instantaneous Calculations: The calculator does fast math for trades. This helps traders make quick choices.

- Risk Help: It shows possible losses and needed money. This helps traders stay safe.

- Better Planning: Traders can see future profits and test ideas. This helps them make smarter plans.

- Easy to Use: The calculator is simple. New and old traders can use it well.

- Full Check: It looks at many trade things. This gives traders a full picture of what might happen.

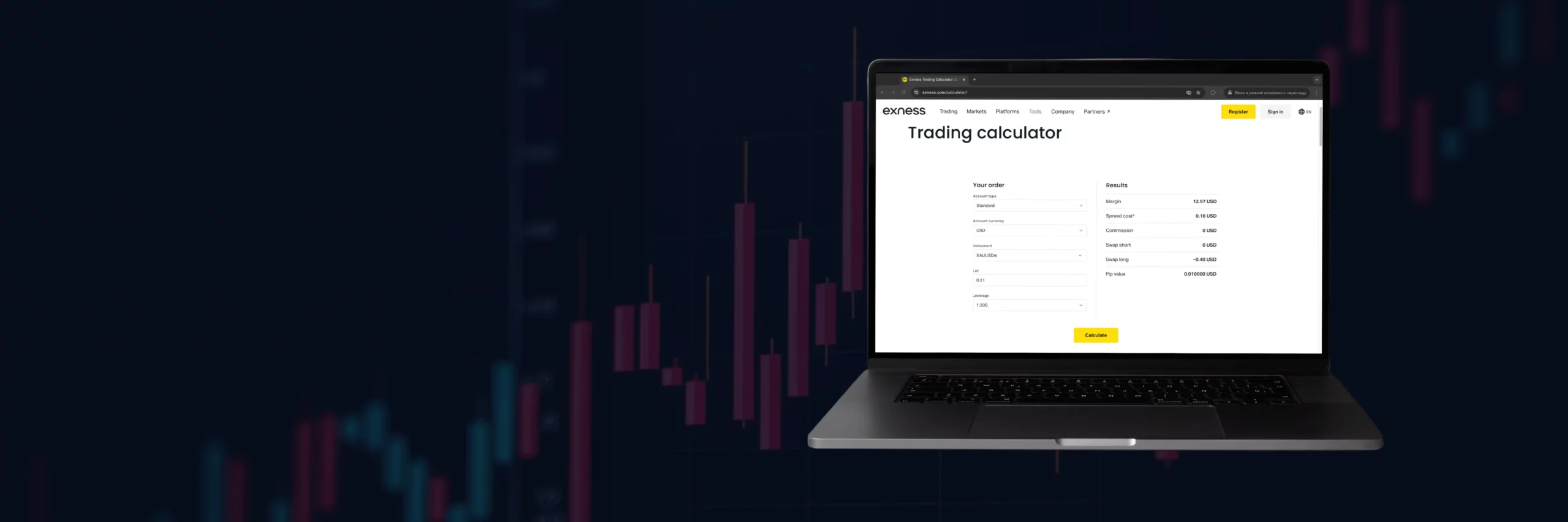

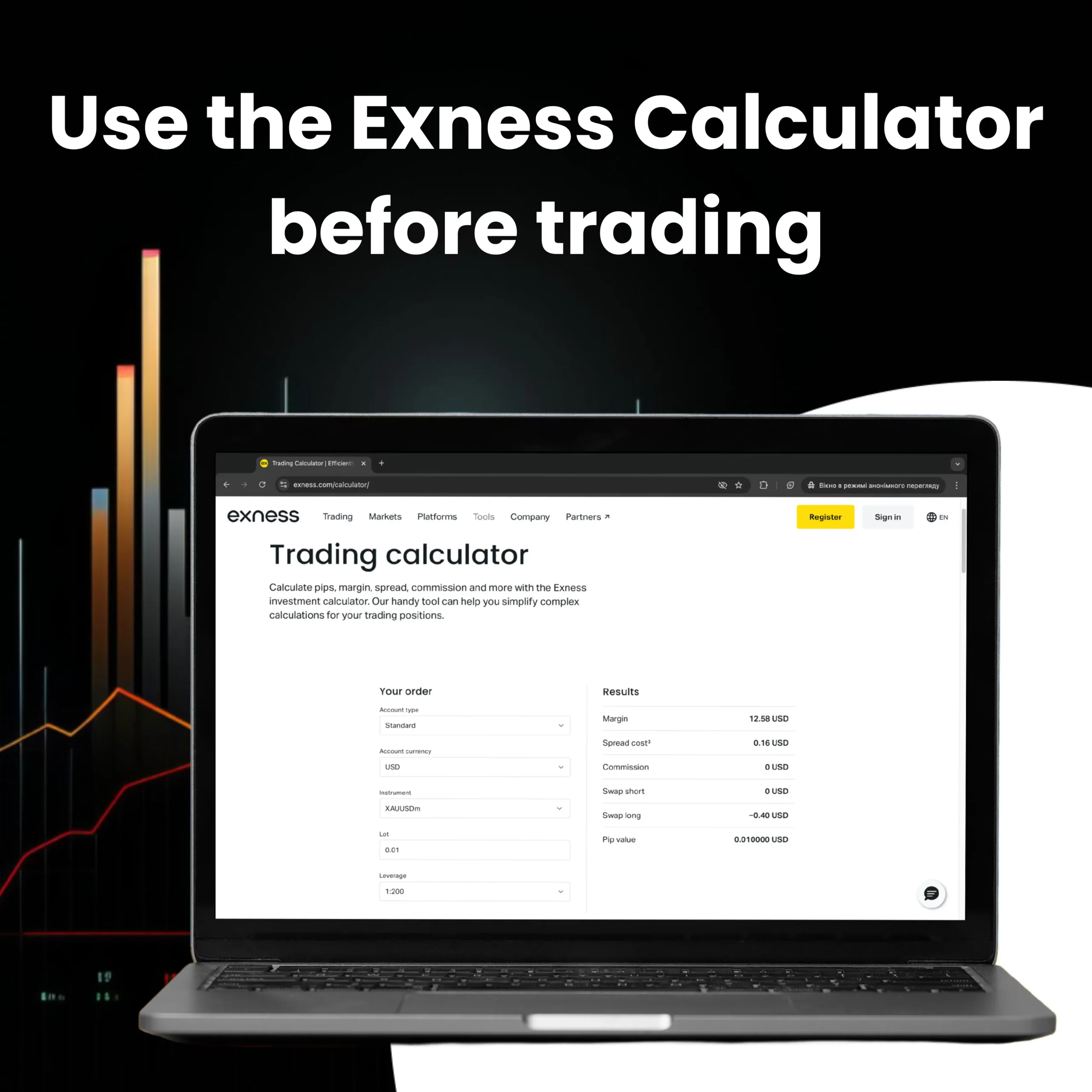

How to Use Exness Trading Calculator

Exness Calculator helps traders plan trades. Traders put in trade details and get full trade info. This helps them make good choices before trading.

Here’s how to use the Exness Trading Calculator:

- Log in to your Exness account. Find the Calculator in the “Tools” part.

- Pick the calculator you need. Exness has calculators for profit/loss, margin, pip value, and swap fees.

- Put in your trade info. This means your account type, money, trade type, trade size, and borrowed money amount.

- Look at what the calculator shows. It tells you about needed money, costs, fees, and trade value.

- Try different trade sizes and borrowed money amounts. See how they change your trade.

- When you like what you see, use this plan in your real trades.

- Use the Exness Calculator often. It helps you get better at guessing trade results and staying safe.

Explain Input Parameters

The Exness Calculator requires traders to specify several key parameters to tailor its output to their specific trading scenarios, enhancing the relevance and accuracy of its calculations.

Account Type:

This input dictates the trading conditions that will apply, including the leverage options and spread sizes available to the trader. Different account types offer varying conditions, which can significantly influence the profitability and risk level of trades.

Account Currency:

Essential for ensuring that the calculated outcomes are presented in a currency that the trader can easily interpret and relate to their account balance. This conversion is crucial for a clear understanding of the financial impact of trades.

Instrument:

The choice of trading instrument is critical, as each has unique characteristics that affect calculation parameters such as pip value and margin requirements. Selecting the correct instrument ensures that the calculator’s output accurately reflects the potential outcomes of trades in that specific market.

Lot Size:

Represents the volume of the trade and is directly correlated with the potential profit or loss that can be realized. The lot size is a key determinant of trade size and impacts the amount of capital at risk.

Leverage:

By adjusting the leverage, traders can control the size of the position relative to their investment capital. Leverage is a powerful tool that can amplify both potential returns and losses, making it a critical factor in risk management and capital allocation strategies.

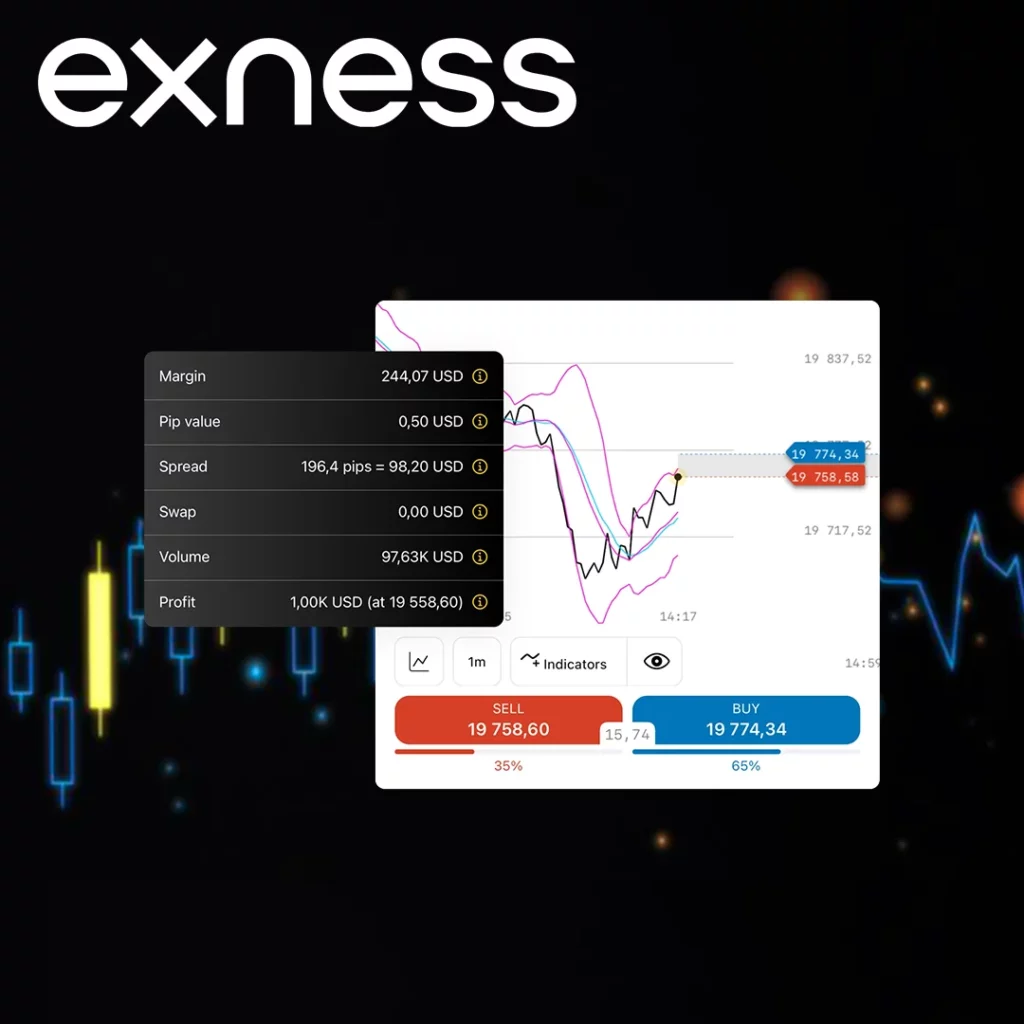

Explain Results

The calculator’s output offers crucial insights into various financial aspects of the planned trade, including both direct costs and potential earnings.

Margin:

Indicates the amount of capital required to open and maintain the position, serving as a key budgeting tool for traders. Understanding margin requirements is essential for effective capital management.

Spread Cost:

Represents the difference in cost between the buy and sell price at the time of trade entry. This cost directly affects the initial expense of entering a trade and can impact overall profitability.

Commission:

Any broker fees charged for executing the trade are detailed here. Commissions are an important consideration when calculating the net profit or loss of a trade.

Swap Short:

Swap short reflects interest paid or received for overnight short positions, determined by the interest rate difference between traded currencies. Positive if the sold currency’s rate is higher, it impacts trade profitability.

Swap Long:

Swap long applies to overnight long positions, with interest influenced by the currency rates involved. Earning occurs if the bought currency’s rate surpasses the sold, affecting trade outcomes.

Pip Value:

This shows the value of a one-pip movement in the trading instrument relative to the account currency. Understanding pip value is crucial for assessing the potential impact of market movements on the trade.

Example of Using Exness Trading Calculator

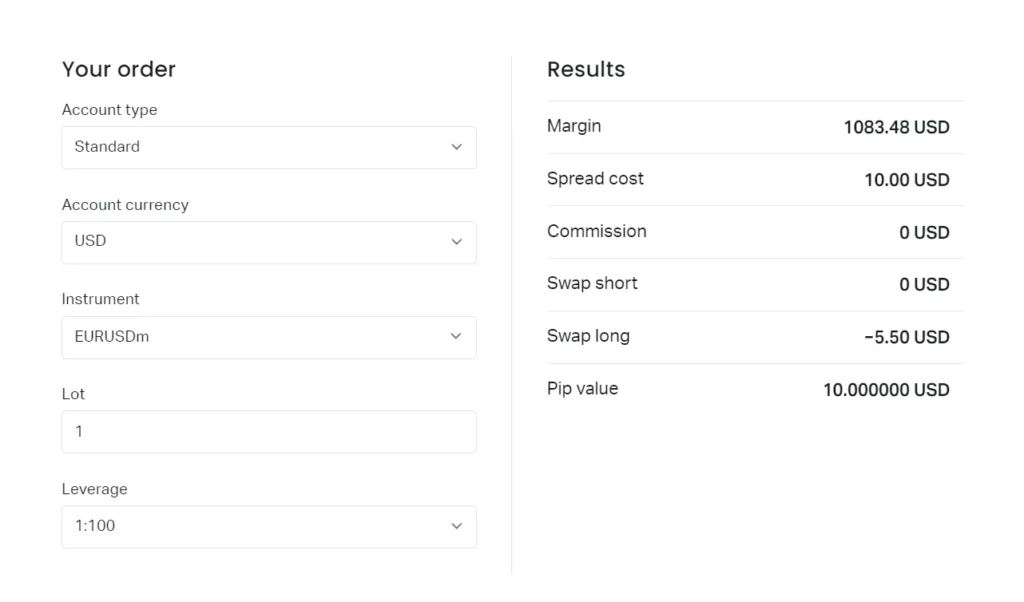

Imagine a trader planning to open a long position on the EUR/USD currency pair with the following parameters:

- Account Type: Standard

- Account Currency: USD

- Instrument: EUR/USD

- Lot Size: 1 lot (100,000 units)

- Leverage: 1:100

After inputting these details into the Exness Calculator, the trader reviews the calculated outcomes:

| Results | Explanation |

| Margin: 1083.48 USD | Margin is the money needed to open a trade. Exness calculates it using leverage and trade size. It protects traders from big losses. |

| Spread cost: 10.00 USD | Spread is the difference between buy and sell prices. Traders pay this cost when opening a trade. It affects initial trade profit. |

| Commission: 0 USD | Commission is a fee for making trades. This trade has no commission, saving the trader money. |

| Swap short: 0 USD | Swap is a fee for keeping trades open overnight. There’s no fee for short trades here. |

| Swap long: −5.50 USD | Long trades have a $5.50 nightly fee. This reduces profit for trades kept open for days. |

| Pip value: 10.000000 USD | A pip is a small price change. Each pip is worth $10 in this trade. If the price moves one pip, the trader gains or loses $10. |

Advanced Features of Exness Calculator

This tool does more than show profits and losses. It helps manage risk, customize settings, and works with trading platforms. These features help traders make better decisions.

Advanced Risk Management

Users can set stop-loss and take-profit levels. This helps control risk and protect money. Traders adjust these settings to match their risk tolerance.

Customization Options

Every trader is different. The calculator lets users change settings to fit their needs. They can input their own trading conditions and strategies, making results more useful.

Integration with Trading Platforms

The tool works with trading platforms. Results can be used in trades without retyping numbers. This makes trading faster and reduces mistakes.

Conclusion

The Exness Calculator is a trading tool made by Exness in 2020. It helps traders plan their trades and manage risk. The calculator can analyze trades, show potential profits or losses, and let users adjust settings. Traders can use it on computers or phones. Trading Calculator works with the Exness trading platform. New and experienced traders use it for forex, stocks, and crypto trading. The tool helps traders make better decisions by showing them important numbers about their trades.