How to Use the Exness Trading Platform

Exness offers a variety of trading platforms to suit different user preferences and trading styles, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness Terminal. These platforms are accessible via desktop, web, and mobile devices, providing flexibility for traders to manage their accounts and trades from anywhere.

The Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner or an experienced trader, understanding how to navigate the platform and make the most of its features is essential. This guide will walk you through the Exness user interface, explain key tools and buttons, and provide detailed instructions on how to use the platform effectively for trading.

Getting Started with Trading on Exness

Once you’ve completed your registration and gained access to the Exness trading platform, you’re ready to start trading! However, before diving into the markets, it’s important to familiarize yourself with the various tools and features available to ensure a smooth and successful trading experience. Below is a step-by-step guide on what to do next after registration:

Log into Your Account

After completing your registration and verifying your account, log in to the Exness platform using your credentials (username and password). Once logged in, you’ll be presented with the Dashboard, which provides a summary of your account balance, margin levels, and recent activities. This overview helps you quickly assess the current state of your account.

Set Up Your Trading Environment

To begin trading effectively, consider customizing your user interface to suit your preferences:

- Choose Your Language: Select the language in which you are most comfortable.

- Set Your Time Zone: Adjust the platform’s time zone to match your local time, ensuring accurate trade timestamps.

- Customize Chart Layouts: You can change the layout and appearance of charts and set up color schemes to enhance your analysis.

Having these settings adjusted will ensure you can navigate and use the platform comfortably.

Deposit Funds into Your Account

Before placing trades, ensure you have sufficient funds in your Exness account. Navigate to the Funds Management section where you can deposit money using various payment methods (e.g., credit/debit cards, bank transfers, e-wallets). Once your funds are deposited, they will be available for trading.

Select a Trading Instrument

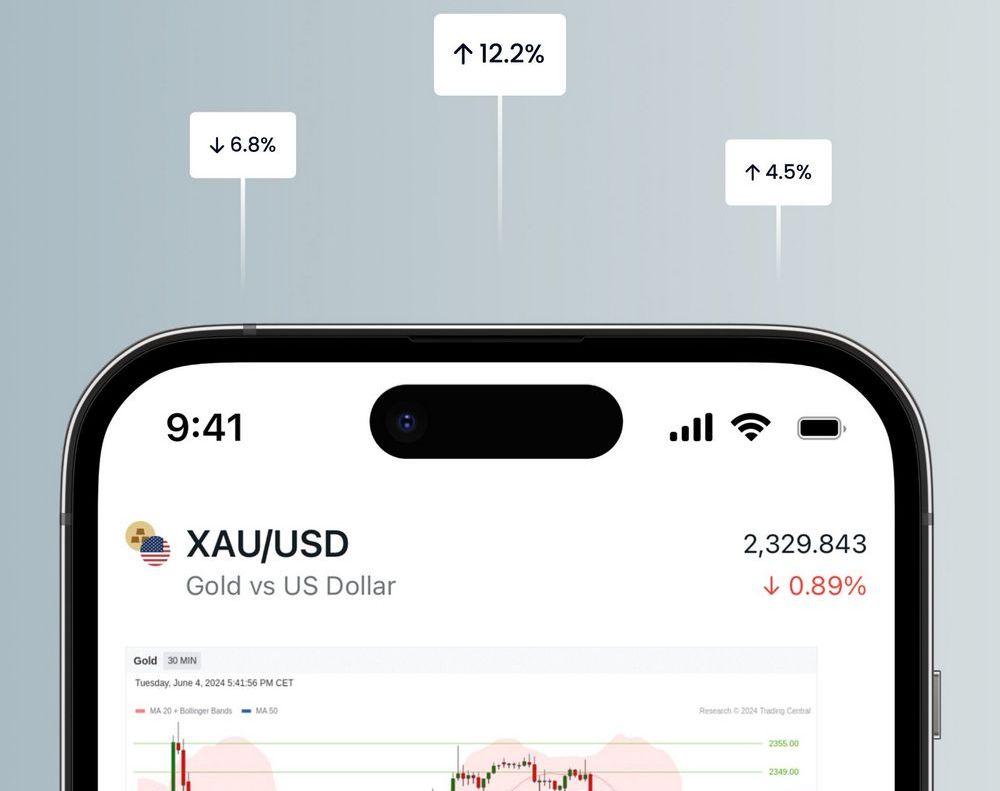

The next step is to choose which financial instruments you want to trade. This can be done through the Market Watch section, which lists available instruments, including forex pairs, commodities, indices, and cryptocurrencies.

- Click on an instrument from the list to add it to your workspace for quick access.

- You can also categorize instruments into groups (e.g., Forex, Cryptocurrencies, Commodities) to keep your workspace organized.

Open a Chart for Analysis

Once you’ve selected a trading instrument, open a price chart to begin analyzing the asset’s movement. Exness offers several types of charts:

- Line Charts: Simple charts that show closing prices over time, useful for spotting long-term trends.

- Candlestick Charts: Show detailed price movements (open, close, high, low) for each time period, ideal for more in-depth analysis.

- Bar Charts: Similar to candlesticks but without color coding.

Use these charts to identify trends, patterns, and potential trading opportunities.

Apply Technical Indicators

To enhance your chart analysis, you can apply technical indicators such as:

- Moving Averages (MA): Helps identify market trends by smoothing out price data.

- Relative Strength Index (RSI): Measures market momentum to indicate overbought or oversold conditions.

- Bollinger Bands: Shows market volatility and helps spot price breakouts.

These indicators provide insights into market trends, momentum, and volatility, which are essential for making informed trading decisions.

Set Your Risk Management Tools

Before placing any trades, it’s important to set up your risk management tools:

- Stop-Loss Orders: Automatically close your position if the market moves against you, limiting potential losses.

- Take-Profit Orders: Automatically close your position when your desired profit is reached.

- Pending Orders: Set conditions to enter a trade at a specific price level, such as Buy Limit or Sell Stop orders.

These tools help you manage your risk by ensuring you don’t lose more than you’re willing to on a trade, and they can also secure profits when the market reaches your target.

Place a Trade

Once you’ve set up your analysis and risk management parameters, you can place a trade:

- Market Orders: Execute a trade immediately at the current market price.

- Pending Orders: Place an order at a specific price level (Buy Limit, Sell Stop, etc.).

After placing the order, you can monitor it from your Trade History and adjust the settings as needed.

Monitor Your Account and Trades

As you continue trading, it’s important to monitor both your account overview and the market conditions. The Trade History section logs all your trades, including entry and exit prices, profit/loss, and trade volume. This helps you track your performance and analyze past trades to refine your strategies.

You can also set up email notifications or SMS alerts to stay updated on important events, such as margin calls, order execution confirmations, or price alerts.

Withdraw Earnings

Once you’re satisfied with your profits or wish to withdraw funds, navigate to the Funds Management section. Follow the instructions for withdrawals, and ensure your payment details are accurate. Note that some payment methods may take longer to process, and withdrawals are subject to verification procedures for added security.

Conclusion

The Exness trading platform is easy to use and suitable for both beginners and experienced traders. It offers options like MT4, MT5, and Exness Terminal, so users can choose the one that fits their style. By learning the platform’s features, customizing settings, and using tools like charts and indicators, traders can improve their analysis and decisions. Risk management and monitoring tools also help reduce risks and improve performance. Exness provides everything traders need to succeed in the markets.

FAQ for Exness Trading Platform

What trading platforms does Exness offer?

Exness offers three platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness Terminal. You can use them on your computer, online, or on your phone.

How do I start trading on Exness?

After registering and verifying your account, log in to the platform, customize it to your liking, deposit funds, and choose a trading instrument to begin.

What technical indicators can I use on Exness?

Exness offers indicators like Moving Averages (MA) to follow trends, Relative Strength Index (RSI) to measure momentum, and Bollinger Bands to spot price changes.

How can I place a trade on Exness?

You can place a trade with a Market Order, which is done right away at the current price, or a Pending Order, which waits for a specific price to be reached.

How do I monitor my trades on Exness?

You can check your trades in the Trade History section and set up alerts to be notified of important events like trade confirmations or margin calls.

How can I withdraw funds from my Exness account?

To withdraw money, go to the Funds Management section and make sure your payment details are correct. Some methods may need extra verification or take more time.

Is there a mobile app for Exness?

Yes, Exness has mobile apps for both Android and iOS, so you can trade and manage your account from your phone anytime.

Explore our latest posts to level up your trading experience.

- How to Use the Exness Trading PlatformThe Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner or an experienced trader, understanding… Read More »How to Use the Exness Trading Platform

- How to Protect Your Exness AccountCreate a Strong and Unique Password A strong password is the primary defense against unauthorized access to an Exness account. Weak or simple passwords are vulnerable to being guessed or cracked by malicious actors. To… Read More »How to Protect Your Exness Account

- Exness User Interface OverviewDashboard and Market Overview Upon logging into the Exness platform, the Dashboard is the first screen traders see, providing a quick overview of their account’s status and the market conditions. Account Information At the top… Read More »Exness User Interface Overview

Feel free to peruse all our posts about online trading for a comprehensive experience.