How to Change Leverage on Exness?

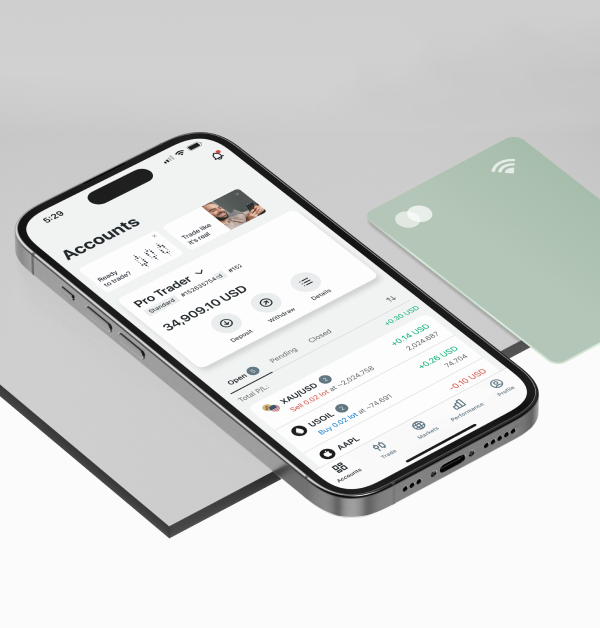

Trading in forex is complex. To do it well, you need to know about markets and the things that affect trading. One important thing is called leverage. It can make your wins big, but also your losses. Traders want to make their plans strong and handle risk. This means they need to be able to change their leverage level. This guide will show you how to do this on Exness, a top forex broker that is easy to use and has lots of trading tools.

Changing how much you can borrow on Exness is more than just a technical change; it’s a big decision that needs thinking about many things. From making the most of chances to making risks smaller, the level of borrowing can really change how your trading goes. As we look at the steps to change borrowing on Exness, traders will get an idea about how to manage borrowing and know how to use Exness’ system to make good choices about their trading. Whether you want to make your chances bigger or be safe from changes in the market, knowing how to change borrowing on Exness helps traders to make their plans better and have a better trading time on one of the top places for trading.

Understanding Leverage

Knowing how leverage works is important for traders in the forex market. It lets traders handle bigger positions with less money, making both profits and losses bigger. Leverage acts like a sword that cuts both ways, making market movements affect traders’ accounts more. With leverage, traders can control a bigger position than their first investment, possibly making more money when the market’s good. But, it’s important to know that more leverage also means more risk, so losses can add up fast if trades go against the trader.

To understand leverage, it’s important to know how it works. Leverage is often shown as a number, like 50:1 or 100:1, which tells how much a trader can control in relation to their starting money. For example, with 100:1 leverage, a trader can control a big position with only a small deposit. While leverage can bring big gains, traders need to be careful and use strategies to protect their money. By knowing how leverage works and its effects on trading, traders can make smart choices and trade forex with more confidence.

Steps to Change Leverage on Exness

Altering leverage on Exness is easy. It helps traders adjust risk and strategies. Here’s how to change leverage on Exness:

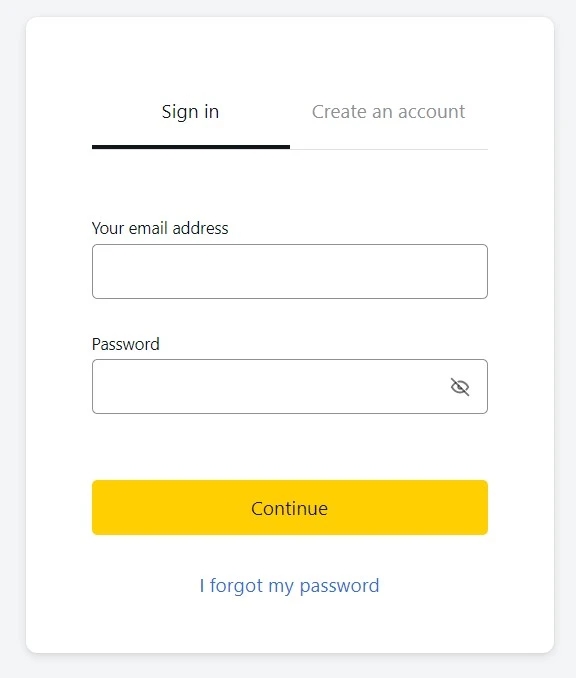

- Log in to Your Exness Personal Area: Go to Exness site and sign in with your details. This special page is where you control your trading and change account stuff.

- Navigate to Account Settings: After you log in, go to your personal area and find account settings. You can change different things in your trading account there, like leverage.

- Select the Account You Want to Adjust: If you have lots of trading accounts with Exness, pick the exact account you want to change the leverage for. Different accounts might have different leverage choices depending on account type and rules.

- Locate the Leverage Adjustment Option: In your account settings, find the choice to change leverage. It might be called “Change Leverage” or “Leverage Adjustment,” depending on where you look.

- Choose the Desired Leverage Level: When you find the way to change the leverage, you can pick the level you want from a menu. Exness gives different leverage choices, from low to high, based on account type and rules.

- Review and Confirm Changes: Before you make changes to the leverage, check that the level you pick matches your trading goals and how much risk you can handle. Also, think about how more leverage might affect your trades and the total money in your account.

- Monitor Your Positions: After you change how much you can borrow on Exness, keep an eye on your trading and how well your account is doing. Watch out, especially if you choose to borrow more. Be careful to handle danger well and think about changing how much you can borrow as the market changes.

Considerations When Changing Leverage

When you change how much you borrow on Exness or another forex website, it’s really important for traders to think about a few important things. That way they can make good choices and control risk well. Here are some things to think about when you change how much you borrow:

Risk Tolerance: Think about your comfort with risk and what you want to achieve in trading before you adjust leverage. More leverage means you can make bigger trades with less money at the start, but it also makes changes in the market have a bigger effect on your account.

Market Conditions: Check market and how much it is moving before changing how much you borrow. If the market is moving a lot, it can make big changes and make you lose money. So, be careful if you are borrowing a lot.

Trading Strategy: Think about how using more or less borrowed money fits with your trading plan. Various trading plans need different amounts of borrowed money to work well.

Account Size: Consider your account size when changing leverage. Higher leverage can make big profits, but also big losses.

Margin Requirements: Know the deposit needed to use different leverage. More leverage means need less deposit to start, but also means small price change can cause need for more deposit or close position.

Regulatory Restrictions: Check rules on how much you can borrow in your area. Exness follows rules and might set the most you can borrow based on rules.

Best Practices for Leverage Management

Good control of power is important for traders to do well in the forex market and keep their money safe. Here are some good ways to do it:

- Understand Leverage: Learn about using leverage in trading. Know how using leverage makes gains and losses bigger. Decide how much risk you can handle before changing how much leverage you use.

- Use Leverage Wisely: Using more money in trading can increase potential gains, but it needs care. Do not use too much money that can bring too much risk and big losses. Instead, find a middle ground that matches your plan and risk comfort.

- Assess Market Conditions: Check market and how fast prices change before changing how much you borrow. Be careful when prices change a lot, because it can increase the chance of getting a call from the people you borrow from or having to end your trades.

- Implement Risk Management Strategies: Use strong risk plans to reduce losses when using borrowing. Use stop-loss orders to limit risk, and never risk more than a set percentage of your account on one trade. This will help you manage potential losses when using leverage.

- Regularly Review Leverage Settings: Check and change how much you borrow when you trade often. Keep an eye on changes in the market and how well you do. Change how much you borrow based on how things change, like how wild the market is, how much money you use, or how you trade.

Conclusion

Good leverage use is key for success in forex trading. It helps traders control risk and protect money. By knowing leverage effects, reading market conditions, and using strong risk strategies, traders can trade wisely. Leverage can boost trading while cutting the chance of big losses, leading to long-term success.

Traders need to be smart and keep up to date, check how much they can borrow often, and change as the market changes to manage borrowing well over time. By being patient and making good choices, traders can lower the dangers that come with borrowing money and get in a good place to make steady money in the forex market. Using borrowing in a careful and smart way is really important to meet trading goals and protect against possible problems, making good borrowing part of good trading plans.

Explore our latest posts to level up your trading experience.

- Who Owns Exness?An Intro to Exness First, some background. Exness is a forex and CFD broker that provides trading services to retail and institutional clients around the globe. Launched back in 2008, they’ve grown rapidly to become… Read More »Who Owns Exness?

- Is Exness Reliable?I’ll do my best to provide an unbiased, data-driven assessment based on tracking Exness over many years. But as always, you’ll need to decide if they’re a good fit for your personal trading needs and… Read More »Is Exness Reliable?

- Is Exness Legit?As more people join in the forex market, it’s really important to make sure trading companies like Exness are honest and trustworthy. Checking if Exness is following the rules and keeping people’s money safe is… Read More »Is Exness Legit?

Feel free to peruse all our posts about online trading for a comprehensive experience.