Exness User Interface Overview

The Exness user interface is designed to be intuitive, with a clean layout that provides easy access to important trading functions and tools. The interface is divided into several key sections, each providing specific features for traders to manage their trades and accounts.

Dashboard and Market Overview

Upon logging into the Exness platform, the Dashboard is the first screen traders see, providing a quick overview of their account’s status and the market conditions.

Account Information

At the top of the screen, the Account Information section displays key details:

- Account Balance: Total funds in the account.

- Equity: Account balance plus or minus floating profits/losses from open trades.

- Margin Level: Indicates the risk level based on margin used and available funds.

- Free Margin: Available funds for opening new positions.

Navigation Panel

The Navigation Panel on the left side allows quick access to:

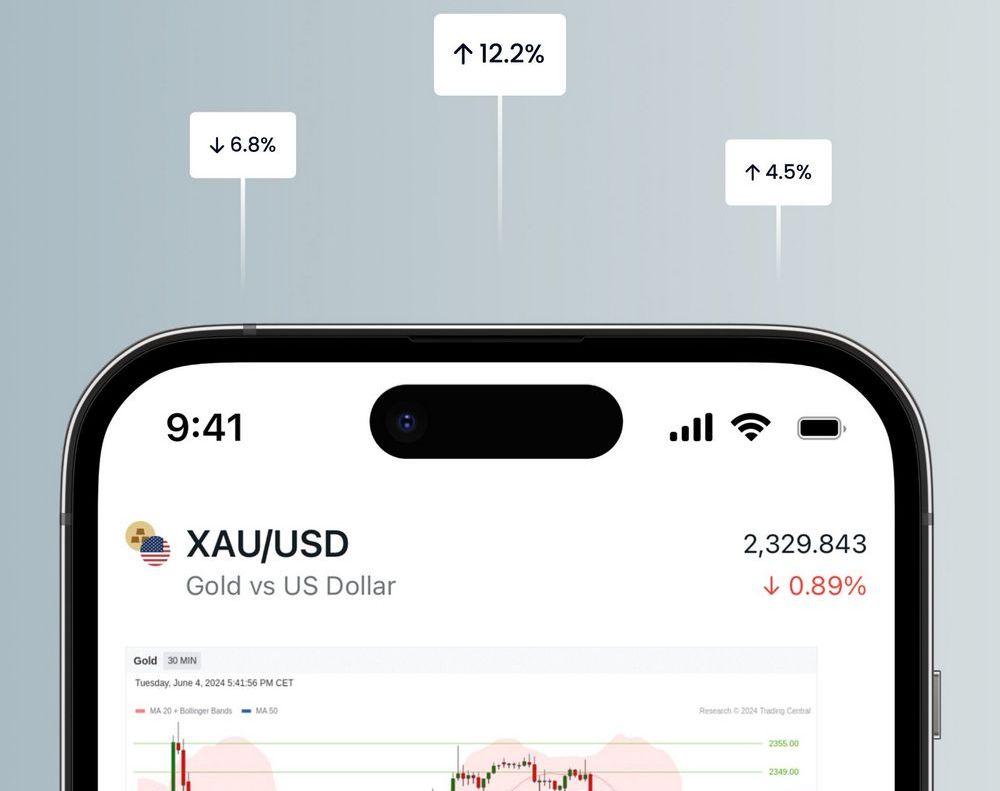

- Market Watch: Displays available trading instruments and their bid/ask prices.

- Charts: Shows real-time price charts for selected instruments with various analysis tools.

- Trade History: Provides a log of executed trades and performance.

- Navigator: Manages accounts, expert advisors (EAs), and indicators.

Market Overview

In the central area, the Market Overview section provides:

- Bid/Ask Prices: Essential for understanding market conditions.

- Price Charts: Visual representation of price movements, customizable by timeframes and chart types.

- Market Depth: Shows buy and sell orders, useful for assessing liquidity.

Market Watch and Trading Tools

The Market Watch section on the Exness platform is essential for monitoring market conditions and executing trades quickly. It provides real-time price data for a wide range of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Instrument List

The Instrument List displays all available instruments, which traders can select and categorize into groups such as Forex, Commodities, or Cryptocurrencies. This helps organize assets for quick access and monitoring.

Quick Execution – The Quick Execution feature allows traders to execute trades directly from the Market Watch:

- Buy/Sell: Right-click an instrument to instantly place a buy or sell order.

- Order Parameters: Traders can set Stop Loss, Take Profit, and other parameters directly from the Market Watch, streamlining the trading process.

Customization

Traders can customize the Market Watch by adding/removing instruments, adjusting columns, and sorting based on criteria like price or name, ensuring a tailored trading experience.

Real-Time Data and Spread Information

Market Watch provides live price updates and displays the spread for each instrument, helping traders assess trade costs and make quick decisions based on market conditions.

Charts and Technical Analysis Tools

The Charting Section on the Exness platform is essential for traders who rely on technical analysis. It displays real-time price movements and provides tools for analyzing market trends.

Chart Types

Exness offers several chart types:

- Line Charts: Simple representation of closing prices, ideal for long-term trend analysis.

- Candlestick Charts: Displays open, close, high, and low prices, providing detailed market insights. It’s popular for spotting market patterns.

- Bar Charts: Similar to candlesticks but without color coding, often used by traders who prefer a minimalist view.

Technical Indicators

Exness provides a wide range of technical indicators to help traders analyze the market and make informed decisions. Below is a table summarizing the key indicators available on the Exness platform:

| Indicator | Purpose | Key Features | Best Used For |

| Moving Averages (MA) | Identifies market trends by smoothing price data. | – Simple (SMA) and Exponential (EMA) options.- Helps smooth out market fluctuations. | Trend-following strategies. |

| Relative Strength Index (RSI) | Measures market momentum to identify overbought or oversold conditions. | – Scale of 0-100.- Overbought (>70) and oversold (<30) signals. | Spotting reversal points and market extremes. |

| Bollinger Bands | Shows market volatility and helps identify price breakouts. | – Consists of three bands: Upper, lower, and middle (SMA).- Expands during high volatility. | Recognizing breakouts and volatility. |

| MACD (Moving Average Convergence Divergence) | Tracks the relationship between short-term and long-term moving averages. | – MACD Line, Signal Line, and Histogram.- Shows momentum and trend strength. | Identifying trend reversals and momentum. |

| Fibonacci Retracements | Identifies potential support and resistance levels based on the Fibonacci sequence. | – Draws key levels (23.6%, 38.2%, 50%, 61.8%).- Helps predict retracement points. | Identifying entry and exit points based on retracements. |

These indicators are essential tools for technical analysis and can be combined to create a comprehensive trading strategy.

Drawing Tools

Exness offers several drawing tools for marking key levels:

- Trendlines: Identify market trends by connecting significant highs and lows.

- Support and Resistance Levels: Mark key price levels where price reversals might occur.

- Fibonacci Retracement Tool: Draws custom retracement levels to identify support/resistance.

Customization

Traders can customize charts with different timeframes, save chart templates, and set price alerts for key levels, making the platform highly flexible.

Order Execution and Order Types

Placing orders is a key component of trading, and Exness provides various order types to suit different strategies. Traders can execute orders directly from the Market Watch or Chart, making it easy to react quickly to market conditions.

Market Orders

A Market Order is executed immediately at the current market price. It is ideal for traders who need to enter or exit the market quickly. The downside is potential slippage, where the execution price may differ from the expected price due to market volatility.

Pending Orders

Allow traders to set price levels for opening positions. They include:

- Buy Limit: Executed when the price drops to the set level.

- Sell Limit: Executed when the price rises to the set level.

- Buy Stop: Triggered when the price moves above the set level.

- Sell Stop: Triggered when the price falls below the set level.

These orders are useful for waiting for specific price levels before entering the market.

Stop-Loss and Take-Profit Orders

- Stop-Loss Orders: Automatically close a trade to limit potential losses if the price reaches a certain level.

- Take-Profit Orders: Automatically close a trade to secure profits once the price hits the target level.

These tools help traders manage risk and ensure trades are closed at the desired points without constant monitoring.

Trade History and Account Management

The Trade History section is a vital tool for traders to track their performance and analyze past trades. This section provides a detailed log of all completed trades, including:

- Date and Time: The specific time a trade was opened and closed.

- Entry and Exit Prices: The price at which the trade was entered and exited, helping traders assess the effectiveness of their trade decisions.

- Lot Size: The number of units or contracts traded, which directly affects trade volume and potential profit or loss.

- Profit/Loss: The realized profit or loss from each trade, allowing traders to review the outcome of their trading strategy.

By regularly reviewing the Trade History, traders can gain insights into their performance over time and identify areas for improvement.

Account Overview

Alongside the Trade History, the Account Overview provides essential information about the trader’s account status:

- Account Balance: The total funds in the account.

- Equity: The total balance, including unrealized profits and losses from open positions.

- Margin Level: A percentage indicating the amount of equity relative to the margin used. It is crucial for understanding the account’s available margin and avoiding margin calls.

- Available Margin: The funds available for opening new positions, which helps ensure there is enough margin to maintain current trades.

This information is essential for monitoring account health, managing risks, and ensuring sufficient margin to support open trades.

Deposit and Withdrawal

The Funds Management section enables traders to manage their deposits and withdrawals effectively. In this section, traders can:

- View Transaction History: Keep track of all deposit and withdrawal activities.

- Select Payment Methods: Choose from various payment options, including credit/debit cards, e-wallets (e.g., Skrill, Neteller), and bank transfers, to transfer funds into or out of their account.

Exness supports multiple payment methods, providing flexibility and convenience for traders to fund their accounts or withdraw earnings. Traders should review payment methods for any associated fees or processing times.

Settings and Personalization

Exness offers several customization options to help traders personalize their platform experience, enhancing workflow and efficiency.

Platform Language

Exness supports multiple languages, allowing traders to choose their preferred language for easier navigation. This is useful for non-English speakers, making the platform more accessible.

Time Zone Settings

Traders can adjust the platform’s time display to match their local time zone. This ensures accurate timestamps for trades, market events, and history, especially for time-sensitive strategies.

Notification Settings

Exness allows traders to set up alerts for:

- Price Alerts: Receive notifications when an instrument reaches a certain price.

- Order Execution Confirmations: Get alerts when orders are successfully executed.

- Margin Calls: Stay informed if margin levels drop below a set threshold.

These alerts can be customized to suit individual needs, delivered via email, SMS, or pop-up.

Chart and Layout Customization

Traders can adjust chart layouts, choose color schemes, and set up hotkeys for faster trading. This flexibility helps traders tailor the platform to their preferences and improve trading efficiency.

Security Settings

Exness provides security features such as Two-Factor Authentication (2FA), account lock, and login alerts to ensure account protection.

Conclusion

Exness is an easy-to-use, customizable trading platform with a wide range of tools. Traders can manage accounts, analyze markets with charts, and execute orders effortlessly. The platform offers real-time data, technical indicators, and different order types for a personalized experience. It also ensures security and offers convenient deposit/withdrawal options, making it suitable for both beginners and experienced traders.

FAQ for Exness

What platforms does Exness offer for trading?

Exness offers three main trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Terminal. These platforms are available for desktop, web, and mobile devices, providing flexibility for traders to manage their trades and accounts from anywhere.

What is the Exness Dashboard, and what can I find there?

The Dashboard provides an overview of your account status, including account balance, equity, margin level, and available margin. It helps traders monitor account health and risk levels before making trades.

How do I place trades on Exness?

Traders can place trades directly from the Market Watch or Chart. Using Market Orders, traders can buy or sell instruments at the current market price. For more specific entries, Pending Orders such as Buy Limit, Sell Limit, Buy Stop, and Sell Stop can be set based on preferred price levels.

What types of orders can I place on Exness?

Exness offers Market Orders, Pending Orders (Buy Limit, Sell Limit, Buy Stop, Sell Stop), and Stop-Loss/ Take-Profit orders. These order types help traders manage risk and execute trades at specific price levels.

What is the purpose of the Trade History section?

The Trade History section logs all completed trades, including entry/exit prices, lot sizes, and profit/loss. It helps traders analyze their performance and refine their strategies over time.

Can I customize the Exness platform?

Yes, Exness offers extensive customization options, including the ability to adjust chart layouts, time zones, notification settings, and language preferences. This allows traders to personalize their workspace and trading experience.

Explore our latest posts to level up your trading experience.

- How to Use the Exness Trading PlatformThe Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner or an experienced trader, understanding… Read More »How to Use the Exness Trading Platform

- How to Protect Your Exness AccountCreate a Strong and Unique Password A strong password is the primary defense against unauthorized access to an Exness account. Weak or simple passwords are vulnerable to being guessed or cracked by malicious actors. To… Read More »How to Protect Your Exness Account

- Exness User Interface OverviewDashboard and Market Overview Upon logging into the Exness platform, the Dashboard is the first screen traders see, providing a quick overview of their account’s status and the market conditions. Account Information At the top… Read More »Exness User Interface Overview

Feel free to peruse all our posts about online trading for a comprehensive experience.