How to Use Exness Trading Signals?

Exness trading signals provide insight into probable market fluctuation and help traders in making informed decisions. To apply these signals, login Exness account, then enter the trading signal section. You will be suggested on different assets, like forex pairs, showing entry and exit points. Go through the signals and their applicability to your trading strategy, and justify them to see if they agree with your view of the market. Remember, signals give indications and not guarantees, so always try mixing them with your research for better results.

Benefits of Using Trading Signals

Trading signals on Exness save time but also enable traders to act more strategically by using professional analysis. These signals quite often use indications of technical and trend ones of the market, providing a more data-driven approach toward trading with less guesswork and improved trading precision. Signals make that easier for traders who cannot invest the time or expertise to analyze deeply, hence finding profitable opportunities more accessible.

Besides that, trading signals can support a trader’s responsiveness in the market. The high-speed market is tough to grasp, and signals help users grasp those opportunities. Beginners also get the learning facility through the signals as they are able to observe exactly how the market conditions crop up and affect the prices of assets, hence useful experience in interpreting trends. Overall, the Exness trading signals serve as supportive tools for a well-founded decision and enhance efficiency in trading.

Access to Trading Signals on the Platform

Within the Exness platform, trading signals are readily available to users, providing professional market analysis directly within your account. To access these features, you can complete an Exness registration and gain full access to valuable tools that support informed trading decisions. In most cases, signals appear either on the trading dashboard or in designated sections designed for easy access, allowing traders to incorporate these insights seamlessly. With real-time updates, Exness ensures that traders receive the most relevant and timely insights into market fluctuations, further enhancing the trading experience.

How to Find Signals on Exness

- Log in to Your Exness Account: Start by accessing your account dashboard.

- Navigate to the Trading Tools Section: Go to the area where Exness offers trading tools or market analysis.

- Select ‘Trading Signals’: Look for the trading signals option to view available insights.

- Review Signals: Choose signals relevant to your preferred assets, such as forex or commodities, to get detailed recommendations.

Types of Signals Available on Exness

Exness offers traders a variety of signals that set them up for an educated decision. This includes: trend signals that define the direction taken by the market; reversal signals that are supposed to indicate possible changes in the trend; momentum signals that define the magnitude of the price time-step movements; and volume signals are also at a trader’s reach to get insight into the level of activities going on within the market.

Precise interpretation of Exness signals requires one to go into the detail concerning the type and the timing of the signal. For example, a trend signal can give either a buying or selling opportunity depending on the direction that the trend takes. Therefore, applying these signals means embedding them with other analytical tools such as indicators and charts, which will help in confirming the prevailing trend and prevailing market conditions. In this way, any trader following the signals would, therefore, apply his judgment much more precisely.

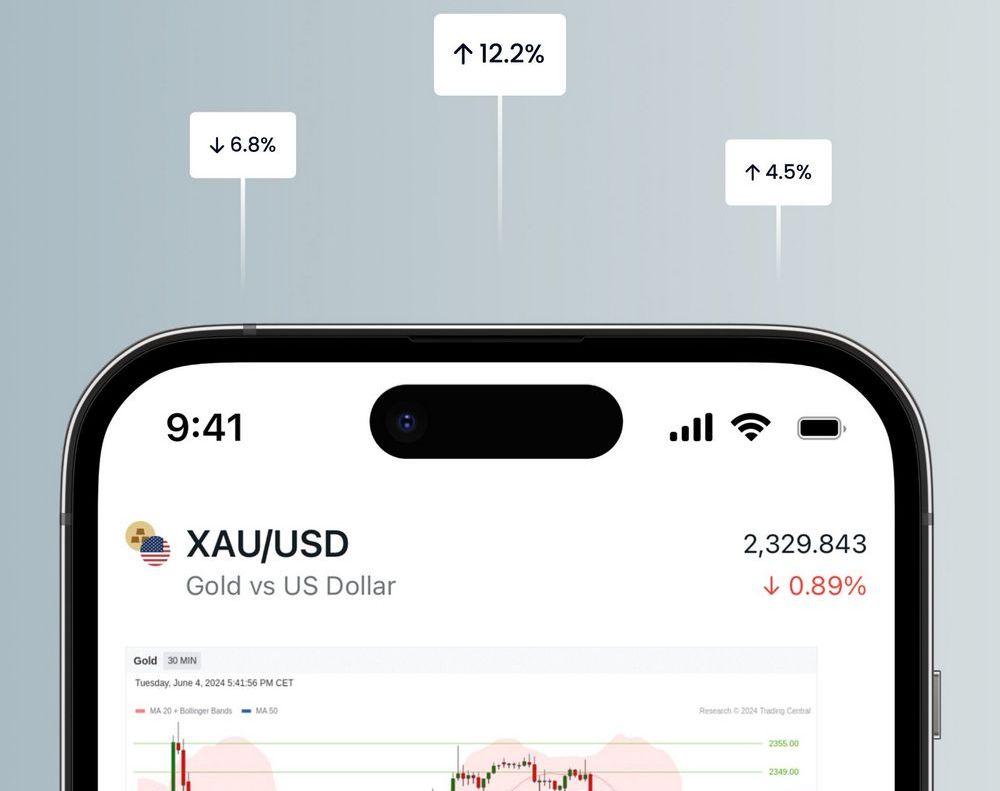

Customizing Signal Notifications

Exness gives traders the opportunity to customize notifications for various signals, ensuring they don’t miss significant market events. By using the Exness mobile app, traders can conveniently adjust settings for notifications, choosing to receive alerts about specific assets, market events, or signal types that match their trading strategies. Notifications can be provided via e-mail, SMS, or push notifications, offering flexibility based on individual preferences. This customization enables users to stay informed with real-time updates, facilitating prompt responses to new trading opportunities or market changes.

Exness also offers variations in setting alerts on specified conditions, such as threshold prices or trend reversals. This allows traders to receive notifications only in specific situations where market conditions they have predefined are met. This will eliminate superfluous alerts from traders and will keep them on track in their trading with timely indications about what they want to identify themselves.

Combining Signals with Your Own Strategy

The trading signals provide further insight into the market trend in a more data-driven manner, thereby allowing for further validation or refinement of the existing strategy. A trader could confirm entry and exit points after cross-referencing the signals with personal analysis, making strategies more compact. In this way, traders can combine automated market insights with personal experience in trading, balancing the reliability of the signals with an approach adapted to trading.

More and more one improves the degree of adaptability in ever-changing markets, the more results from shifting one’s strategy upon some signals. The trader recalibrates his strategy to accommodate that particular insight in case the signals may provide indications of changing trends or in case they have identified the perfect setting for a trade. For example, a signal may indicate that a bullish trend may weaken, and immediately, a trader may adjust stop-loss or take-profit levels. With these minor tweaks, based on the signals, this makes the trader sensitive to market conditions-to better manage risks and position for performance.

Evaluating the Effectiveness of Trading Signals

Exness traders should regularly evaluate the efficiency of trading signals. It also includes an assessment of how well signals coincide with market fluctuations and bring profits. Effective signals ensure accuracy and timely presentation to let traders make their decision, while poor signals will reflect inconsistent results. The frequent assessment helps traders to determine which type of signals works best for complementing their strategy and what changes are yet required to bring additional positive results.

Time Signal Accuracy Tracking

Tracking the accuracy of the signals over time gives traders a better view of their reliability. By keeping a record of the signals used, the trades made, and the result, traders can gain a better understanding of the success rate a given signal has over different market conditions. This historical data will then go on to show in detail the patterns in the performance of various signals, which enables traders to fine-tune their strategy by selecting those that are far more consistent, hence maximizing profitability.

Analysis of Performance Using Signal Data

Signal performance analysis will involve comparing trade results to the suggested actions in the signals. A look at entry and exit points, profitability, and the duration of the trades helps the trader understand which of these signals best fits their objectives. Through such a data-driven approach, traders can go further to identify only those signals that consistently help create value for them and may further refine their strategy to improve decision-making and trade outcomes.

Frequently Asked Questions

Are Exness trading signals suitable for beginners?

Yes, Exness trading signals are suitable for beginners, as they provide market insights and highlight potential trading opportunities. However, it’s recommended that beginners also learn basic analysis techniques for well-rounded decision-making.

Do I need a paid account to access signals?

No, Exness offers trading signals to all clients, including those with free demo accounts, making signals accessible for users at various account levels.

How often are Exness trading signals updated?

Exness trading signals are updated frequently, often daily or intraday, to reflect current market conditions and provide timely information on market trends.

Can I rely solely on signals for my trades?

While Exness signals can inform trade decisions, relying solely on them is not recommended. Using signals in combination with personal analysis can help make more balanced trading choices.

What’s the difference between technical and fundamental signals?

Technical signals are based on chart patterns and indicators, focusing on price movement. Fundamental signals consider economic events, news, and market sentiment to predict potential price changes.

How do I get help interpreting trading signals on Exness?

For assistance with interpreting trading signals, you can contact Exness support or refer to educational resources in the Exness Personal Area to enhance your understanding.ould make use of indicators such as Bollinger Bands or ATR to anticipate when volatility may expand, enabling them to enter trades at the exact time when price action starts blowing strongly in one direction.

Explore our latest posts to level up your trading experience.

- How to Use the Exness Trading PlatformThe Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner or an experienced trader, understanding… Read More »How to Use the Exness Trading Platform

- How to Protect Your Exness AccountCreate a Strong and Unique Password A strong password is the primary defense against unauthorized access to an Exness account. Weak or simple passwords are vulnerable to being guessed or cracked by malicious actors. To… Read More »How to Protect Your Exness Account

- Exness User Interface OverviewDashboard and Market Overview Upon logging into the Exness platform, the Dashboard is the first screen traders see, providing a quick overview of their account’s status and the market conditions. Account Information At the top… Read More »Exness User Interface Overview

Feel free to peruse all our posts about online trading for a comprehensive experience.