Synthetic Indices Availability on Exness

Synthetic indices are not available for trading on Exness. These indices are simulated markets that track price movements without being tied to real-world assets, often popular among traders looking for a constant, predictable trading environment. Exness focuses on offering access to real markets, including forex, commodities, cryptocurrencies, stocks, and indices. If you’re interested in trading synthetic indices, you may need to look at platforms that specifically provide these instruments. However, Exness’s extensive range of tradable assets ensures that traders have diverse options to meet their market needs.

What Are Synthetic Indices?

Synthetic indices are a type of trading instrument that simulates the real movements of markets but is not derived from any real asset. The Synthetic indices, created by algorithms, are available 24/7 and present the trader with the opportunity to exercise various strategies under what amounts to live market conditions but unaffected by world events. Synthetic indices have pre-set levels of volatility, meaning they move predictably within fixed ranges.

Key Features of Synthetic Indices:

- No Real Assets: They are based on simulations rather than actual stocks, currencies, or commodities.

- Consistent Volatility: Traders can choose indices with specific volatility levels, such as 50%, 75%, or 100%.

- Unaffected by the News of the Real World: Synthetic indices are predictable and smooth, since their ground lies on no real-world event.

For example, a trader who wants to backtest some new strategy in an environment where unexpected market events cannot happen might trade with a 75% volatility synthetic index. In such a way, he is able to focus on the technique undisturbed, since unpredictable news can affect his trades.

What Synthetic Indices Are Available on Exness?

Please note that Exness does not offer any synthetic indices on its platform. Synthetic indices are artificially created instruments to simulate price movements, independent of actual events occurring in the real markets. These instruments are in demand because of the predictable conditions they create for trading, as such markets exist 24/7 and are immune to news events and geopolitics. Exness offer CFD trading like forex, commodities, crypto currencies, and conventional indices, doesn’t offer synthetic indices.

Types of Synthetic Indices

On those few that offer synthetic indices, there are many varieties, all with their own unique character, which appeals to various trading styles. A good example is the Volatility Indices; this is a simulation of market volatility normally at pre-set magnitudes-for example, a Volatility 75 Index-which would provide a stable and hence predictable magnitude of fluctuation. These kinds of indices would thus allow traders to apply strategies based on stable volatility undisturbed by outside events in the market.

Another common type is the Crash and Boom Indices: these are those that model market “booms” or “crashes” at random intervals, producing sharp spikes or drops in price. These indices represent the extremities of price movements and are perfect for traders who like very short-term, high-risk trading strategies. Although synthetic indices are not offered by Exness, traders can have a look at its array in real-market assets for variation in trading.

Features of Trading Synthetic Indices

The trading of synthetic indices is unique, as it takes place in a consistent environment. The behavior emulates that of real markets, but independent of news events or other changes in economic data that may normally influence them. Volatility levels are fixed, so traders can choose any index depending on their desired risk. Furthermore, it is always available, so this makes trading feasible at any time during the night or day. This therefore provides a more predictable platform for traders who prefer a more stable environment and technical analysis.

Trading Conditions and Market Consistency

Artificial indices are a controlled environment to trade because their movements are unaffected by economic reports and other geopolitical events. This means that the trader can study their strategies without volatile behaviors in the markets that arise from a sudden occurrence of any factor, thus keeping conditions stable. With pre-set volatility levels, the movement of synthetic indices lies within predictably narrow ranges, thereby making them ideal for traders who seek to be in a controlled environment either for building skills or testing their strategies. For a hands-on experience in a similar stable environment, traders can explore the Exness demo account to practice without real-world risks.

Advantages and Risks of Synthetic Indices

Advantages:

- 24/7 Availability – Synthetic indices are available around the clock, offering constant trading opportunities.

- Independence from External Events – These indices aren’t affected by news or economic data, providing a stable trading environment.

- Fixed Volatility Levels – Traders can select indices based on predetermined volatility, making it easier to align with specific trading strategies.

- Ideal for Technical Analysis – With fewer unexpected market shifts, synthetic indices allow traders to focus heavily on technical analysis.

Risks:

- High Leverage and Volatility – While fixed, the volatility in synthetic indices can still lead to large swings, increasing the risk of significant losses.

- No Real-World Asset Backing – Since these indices are simulated, they don’t represent actual assets, which may lack appeal for traders who prefer market-driven factors.

- Potential Over-Reliance on Technical Patterns – The consistent nature of synthetic indices may lead traders to rely too heavily on patterns, which can result in unexpected outcomes if the indices move outside typical ranges.

- Limited Broker Availability – Not all brokers, like Exness, offer synthetic indices, which may restrict access to this trading option for some.

Comparison with Traditional Market Instruments Exness

Traditional instruments take real-life events into consideration; news, economic data, or even political change influences the rise and fall in their prices. Their opposite, synthetic indices, do not depend on anything happening in the real world and thus provide equal conditions for trading, where the only important factor for the trader is strategy. This makes synthetic indices a popular choice for any trader who prefers predictability and does not want to be at the mercy of global events.

Tools Available at Exness:

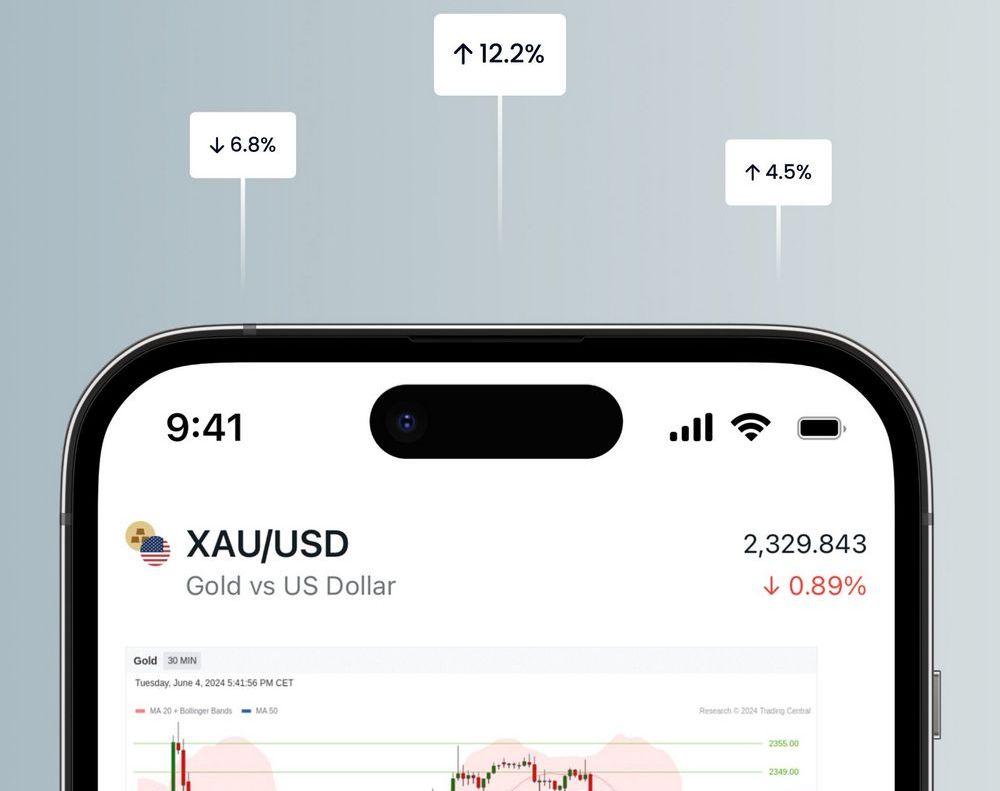

- Forex Pairs: Major, minor, and exotic currency pairs whose prices change with global market conditions

- Stocks: Trade top company shares that react to business news and economic trends.

- Commodities: Gold, oil, and other commodities whose prices are subject to global supply and demand.

- Cryptocurrencies: Bitcoin, Ethereum, and more-recognized for high volatility and influencing markets.

- Synthetic Indices: One will be able to trade on simulated instruments with pre-set volatility and without the interference of exogenous factors.

Let’s say a trader may want to test strategies on synthetic indices that do not have unplanned price movements, but switch over to forex or stocks when some economic releases bring about opportunities. With both types of instruments at their disposal, flexible trading is supported by Exness: users can choose tools based on their goals and risk tolerance.

Strategies for Trading Synthetic Indices

Because of the stable, yet predictable environment, trading in synthetic indices requires a special way of trading. Since it’s not influenced by real-world events, the finest technical-based strategies for synthetic indices include those concerned with price patterns and trends. Volatility-based and trend-following approaches are the key strategies that present traders with the best use of fixed volatility and constant behavior in the market.

Volatility and Trend-Based Strategies

Trend-Following Strategy: Price tends to stay on course longer, without outside intervention, with Synthetic Indices.Trend indicators will be Moving Averages or MACD; using these may help a trader enter in the direction of a trend, with a view to riding the momentum over longer periods. By focusing on established trends, the trader can take advantage of the consistency of the market and capture gains without constant reversals. It is a very effective strategy for traders looking to capitalize on stability with clear directional movements.

Volatility Breakout Strategy: In synthetic indices, volatility usually follows predictability and stability. This is a strategy whereby one identifies the low volatility periods and then starts entering trades at the beginning of a breakout. They could make use of indicators such as Bollinger Bands or ATR to anticipate when volatility may expand, enabling them to enter trades at the exact time when price action starts blowing strongly in one direction.

Explore our latest posts to level up your trading experience.

- How to Use the Exness Trading PlatformThe Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner or an experienced trader, understanding… Read More »How to Use the Exness Trading Platform

- How to Protect Your Exness AccountCreate a Strong and Unique Password A strong password is the primary defense against unauthorized access to an Exness account. Weak or simple passwords are vulnerable to being guessed or cracked by malicious actors. To… Read More »How to Protect Your Exness Account

- Exness User Interface OverviewDashboard and Market Overview Upon logging into the Exness platform, the Dashboard is the first screen traders see, providing a quick overview of their account’s status and the market conditions. Account Information At the top… Read More »Exness User Interface Overview

Feel free to peruse all our posts about online trading for a comprehensive experience.