Swap Charges in Exness

Exness applies swap charges to trades held overnight. These fees display the difference in interest rates between currencies within a pair. If you are trading and holding a position for an extended period, swap charges can significantly affect your ability to make profits while also being considerate of costs.

What Are Swap Charges?

Swap charges are the costs (or benefit) for maintaining a position overnight within forex trading. These fees are a translation of the interest rate differential that exists between two currencies paired in trading. There are brokers, such as Exness, that use an overhead of these charges at the end of every trading day to charge clients account.

For instance, if a trader buys EUR/USD, they’re essentially borrowing USD to buy EUR. If the EUR interest rate is higher than the USD rate, the trader might receive a small credit. Conversely, if the USD rate is higher, the trader pays a fee.

Swap charges can significantly impact trading outcomes, particularly for positions held for extended periods. They’re a standard practice in forex trading, reflecting the real costs of currency exchange in global financial markets.

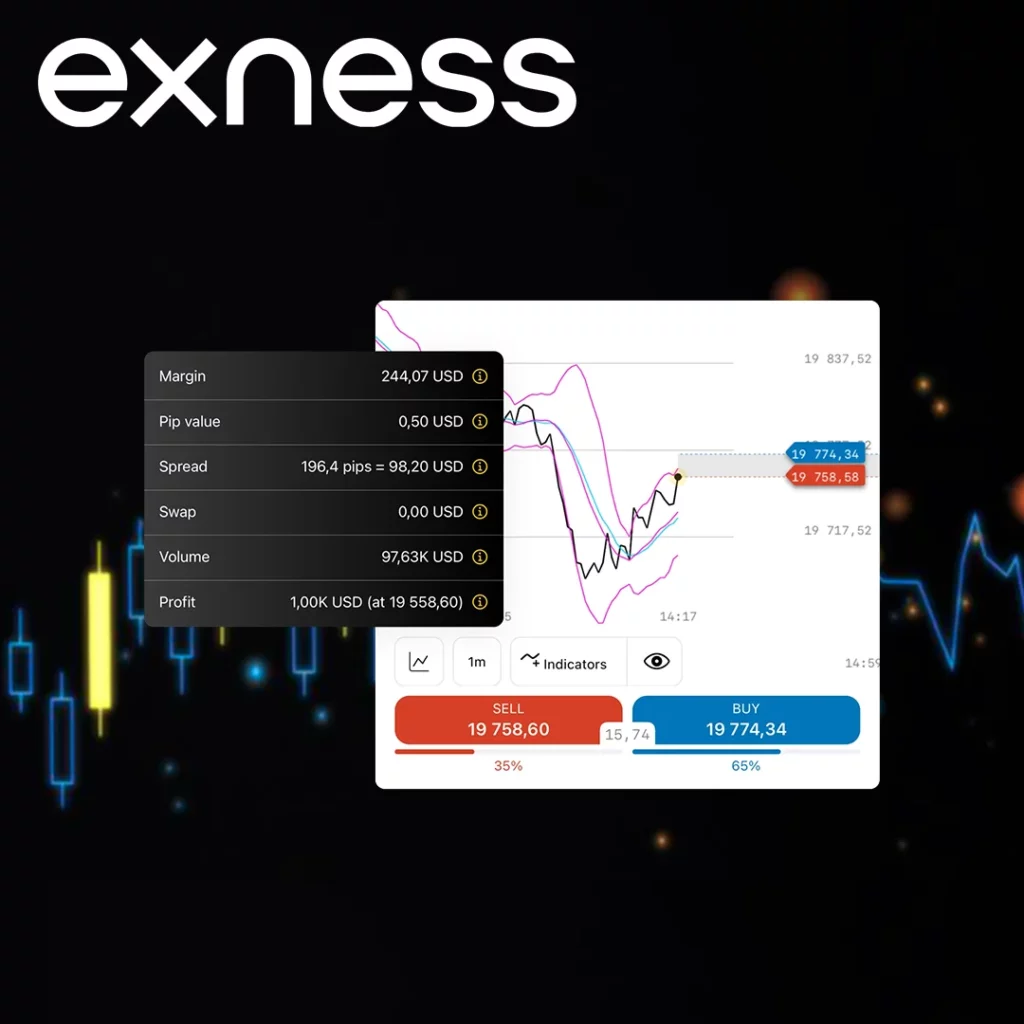

How Swap Charges Work on Exness

Exness calculates and applies swap charges automatically to open positions at 00:00 server time. The process is straightforward:

- Determine the swap rate for the currency pair

- Multiply the swap rate by the position size

- Apply the resulting amount to the trader’s account

For example, a trader with a 1 lot position in EUR/USD might face a swap charge of $5.23 per night (based on current rates). Over a week, this adds up to $26.15 – a notable sum for active traders.

Exness displays swap rates for each instrument in the contract specifications. These rates can be positive (credit) or negative (debit), depending on the interest rate differential and the position direction (buy or sell).

Factors Affecting Swap Charges on Exness

Several elements influence the swap charges on Exness:

- Interest rate differentials: The primary factor – higher differentials lead to larger swap charges.

- Central bank policies: Changes in monetary policy can affect interest rates and, consequently, swap charges.

- Market volatility: Increased volatility might lead to wider spreads and higher swap rates.

- Position size: Larger positions incur proportionally higher swap charges.

- Day of the week: Swap charges are typically tripled on Wednesdays to account for the weekend.

Traders must consider these factors when planning their strategies, especially for trades held over multiple days or weeks. Exness provides up-to-date information on swap rates, allowing traders to make informed decisions about their positions.

Why are Swap Charges Important?

One of the most critical elements in forex trading that has a profound effect on overnight trades is swap charges – often ignored by many traders. These charges, or credits, are also known as interest rates and are charged on positions held overnight at 5 pm New York time; they can vary by currency rate and which way the trade is initiated (long or short). Swap charges are important to understand because they can enhance or diminish the total return of a trade. These incremental, daily costs can add up when traders carry big positions for a long period of time and this may change the expected outcome from a strategy. Additionally, some specific trading instruments/account types may have different swap conditions e.g. forex & metals are triple swaps on Wednesdays which makes it all the more important to include these elements in your trading plan.

Using the Exness Calculator to Check Swap Charges

The Exness Calculator is a valuable tool for traders looking to estimate potential swap charges. Here’s how to use it effectively:

- Access the calculator: Navigate to the Exness website and locate the trading calculator tool.

- Select instrument: Choose the currency pair or trading instrument you’re interested in.

- Enter trade details: Input your trade volume (lot size) and the number of days you plan to hold the position.

- Review results: The calculator will display the estimated swap charge based on current rates.

Use the calculator to compare swap charges across different instruments and account types. This can help identify cost-effective trading opportunities.

Tips for Managing Swap Charges in Exness

Managing swap charges effectively can make a significant difference in trading outcomes, particularly for swing traders and position traders. Here are some tips to help manage these charges:

- Choose Swap-Free Accounts: For traders who follow Islamic principles or prefer not to pay overnight fees, Exness accounts without swaps are a great choice, especially for traders registered in Islamic countries.

- Monitor Trading Days: Be aware of the days when triple swap charges are applied, such as Wednesdays for forex and metals, and plan trades accordingly to avoid or minimize these higher charges.

- Use the Trading Calculator: Regularly use the Exness Trading Calculator to estimate swap costs before placing trades, allowing for better financial planning.

- Consider Short-Term Strategies: For traders looking to avoid swaps altogether, consider focusing on intraday trading strategies that do not involve holding positions overnight.

- Leverage Account Type Benefits: Different Exness account types might have varying swap conditions, so choosing the account that best fits your trading style can help in managing swap-related expenses.

FAQs

Can Swap Charges Be Avoided?

Yes, swap charges can be avoided by using swap-free accounts offered by Exness under specific conditions, particularly for clients in Islamic countries. Additionally, traders can avoid swap charges by closing positions before the market close, thereby not holding them overnight.

How to View Swap Charges on the Exness Platform?

- Log in to your Exness account.

- Navigate to the “Market Watch” window.

- Right-click on the desired instrument.

- Select “Specification” from the context menu.

- Look for the “Swap Long” and “Swap Short” values in the specifications table.

Alternatively:

- Check your account history for detailed swap charge information on past trades.

- Use the Exness mobile app to view swap rates on-the-go.

Do Swap Charges Vary by Account Type?

Yes, swap charges can vary depending on the Exness account type. Factors influencing swap rates include: account currency, leverage, commission structure, special accounts.

Explore our latest posts to level up your trading experience.

- Changing IB in ExnessWhat is an IB (Introducing Broker) in Exness? An Exness Introducing Broker is a partner that refers new traders to the firm. They help clients open Exness account, introduce the basics of trading, and support… Read More »Changing IB in Exness

- Leverage Offered by ExnessLeverage Trading Concept Trading leverage is the facility given to a trader to operate a larger amount in the market by using all or a smaller portion of one’s own trading capital. This is a… Read More »Leverage Offered by Exness

- How to Use Exness Trading Signals?Benefits of Using Trading Signals Trading signals on Exness save time but also enable traders to act more strategically by using professional analysis. These signals quite often use indications of technical and trend ones of… Read More »How to Use Exness Trading Signals?

Feel free to peruse all our posts about online trading for a comprehensive experience.