Exness Minimum Deposit

As a global broker, Exness offers CFD trading on a wide range of assets including stocks, indices, currencies, commodities, cryptocurrencies, and energies. However, before you can begin trading, you’ll need to determine how much fund to deposit into your Exness trading account.

Unlike many brokers with a fixed, often high minimum deposit, Exness takes a different approach. The minimum deposit amount varies based on the payment method and account type you select. This flexibility allows you to start trading with Exness with as little as $1 or even less in some cases, making it accessible to traders of all experience levels and financial backgrounds.

However, the minimum deposit is just one factor to consider when choosing a broker. Equally important are the trading conditions, such as spreads, commissions, leverage, available instruments, and execution quality. Exness excels in these areas, offering competitive trading conditions alongside its low minimum deposit requirement.

Exness Payment Options

Exness provides a wide range of deposit methods to cater to the diverse needs of its global client base. Popular options include bank cards (Visa, Mastercard), bank wire transfers, e-wallets (Skrill, Neteller), and even cryptocurrencies. Each payment method has its unique advantages and drawbacks in terms of speed, fees, availability, and security.

- Bank cards: Quick and easy, with rapid crediting; nevertheless, there may be costs and a need for card verification.

- Bank Transfers: Traceable and Secure, but they take longer because of possible bank fees and processing waits.

- E-Wallets: Simple, rapid, and instantaneous crediting; nevertheless, they require the creation of an account, identity verification, and may incur fees from the e-wallet or Exness.

Exness Minimum Deposit to Your Funding Preference

At Exness, the minimum deposit amount you need to start trading varies depending on the payment method you choose. This flexible approach ensures that traders can select the funding option that best aligns with their budget and preferences, making it easier to kickstart their trading journey.

To help you make an informed decision, we’ve compiled a comprehensive table outlining the minimum deposit requirements for each available payment method. Please note that these amounts are subject to change, and it’s always advisable to cross-check the latest information on the Exness website or in your Personal Area, as they may differ based on your location and currency.

| Payment Method | Minimum Deposit Amount |

| MasterCard | $3 |

| Visa | $3 |

| Bank Transfer | $50 |

| Skrill | $10 |

| Neteller | $10 |

| Webmoney | $10 |

| Perfect Money | $0.01 |

| Fasapay | $1 |

As you can see, the minimum deposit requirements span a wide range, catering to diverse financial capabilities. For instance, if you prefer the convenience of credit cards, the minimum deposit for Visa and MasterCard is $3. On the other hand, if you’re looking for an ultra-low-cost entry point, Perfect Money allows you to fund your account with as little as $0.01.

Exness Minimum Deposit Requirements for Traders

Selecting a broker with flexible minimum deposit criteria is essential for traders who are new to online trading, particularly those with minimal funds or those who are just beginning out. Exness, a well-known international broker, understands this need and provides traders with an affordable way to enter the financial markets.

In addition to spread and commission, other important considerations when selecting a broker are leverage, instruments, and execution. For traders, Exness provides the UPI Pro method, which makes it simple and fee-free to make deposits and withdrawals with a $10 minimum. You’ll need a unique UPI ID, a UPI app like Google Pay, and a validated Exness account in order to use UPI Pro.

Exness accepts more deposit options as well, each with pros and cons of their own, such as bank cards, bank transfers, e-wallets, and cryptocurrency. Compare the various approaches according to availability, cost, speed, and security to make an informed decision. You can access your Personal Area or the Exness website for more detailed information.

Exness Minimum Deposit for Different Account Types

Standard, Standard Cent, Pro, Zero, and Raw Spread are the five account categories offered by Exness. Spread, commission, leverage, instruments, and execution are different. Select the option that best meets your trading requirements.

The minimum deposit required by Exness varies based on the area and mode of payment. While Pro, Zero, and Raw Spread require a minimum deposit of $200, Standard and Standard Cent typically have no minimum requirement. The Exness minimum deposit for each type of account is summarised as follows:

- Standard Account: Ideal for both beginners and experienced traders, the Standard account offers market execution, stable spreads, no commissions, and unlimited leverage. The minimum deposit amount varies based on your chosen payment method but can be as low as $1, making it an accessible option for traders with limited capital.

- Standard Cent Account: Similar to the Standard account but tailored for micro lot trading (0.01 of a standard lot), the Standard Cent account boasts even lower minimum deposit requirements, starting from as little as $0.01 when using Perfect Money.

- Pro Account: Designed for professional traders seeking low spreads, high leverage, and swift execution, the Pro account charges a commission of $3.5 per lot per side but offers access to a broader range of instruments, including stocks and indices. The minimum first-time deposit for this account type is $200, although this may vary depending on your region.

- Zero Account: Catering to advanced traders who prioritize zero spreads, high leverage, and market execution, the Zero account charges a commission of $3.5 per lot per side but delivers the best pricing and liquidity. The minimum first-time deposit for this account is $200, subject to regional variations.

- Raw Spread Account: Tailored for experienced traders seeking ultra-low, stable spreads, the Raw Spread account charges a fixed commission per lot, which depends on the traded instrument. Like the Pro and Zero accounts, the minimum first-time deposit for this account type is $200, with potential regional variations.

Commission for Exness Deposits

Exness doesn’t impose any commissions or fees on deposits. Nevertheless, there may be a transaction fee or commission that is applied by your bank, payment system, or bank that Exness is unable to regulate. As a result, before placing a deposit, you should review the terms and conditions of your chosen payment option.

Currency conversion fees are levied on certain payment methods when money is deposited or withdrawn in a currency other than the one linked to your account. For instance, your payment method may charge you a currency translation fee if you put USD into your EUR account. Selecting a payment option that works with the currencies on your account will help you avoid this charge.

Exness Deposit Processing Times

The processing time for deposits varies depending on the chosen payment method. While most options facilitate instant or near-instant crediting of funds to your Exness account, some methods like bank transfers may take longer, typically 3-5 business days, due to extended bank processing times.

The majority of payment options often provide rapid or very instantaneous deposits, meaning that the money is deposited to your Exness account in a matter of seconds or minutes. Nevertheless, depending on the bank processing time, certain payment options, such bank transfers, could take longer. They could take as long as three to five business days.

Which currencies may I deposit money with Exness?

Depending on the payment method and the location, Exness offers deposits in a number of different currencies. Major currencies including USD, EUR, GBP, JPY, and BTC are available for selection, in addition to regional currencies like INR, IDR, THB, and ZAR. However, you should note that if your deposit currency does not match your trading account currency, you may incur currency conversion fees from your payment method or Exness. Selecting a payment option that supports the currency of your account is therefore advised.

How to Make a Minimum Deposit with Exness

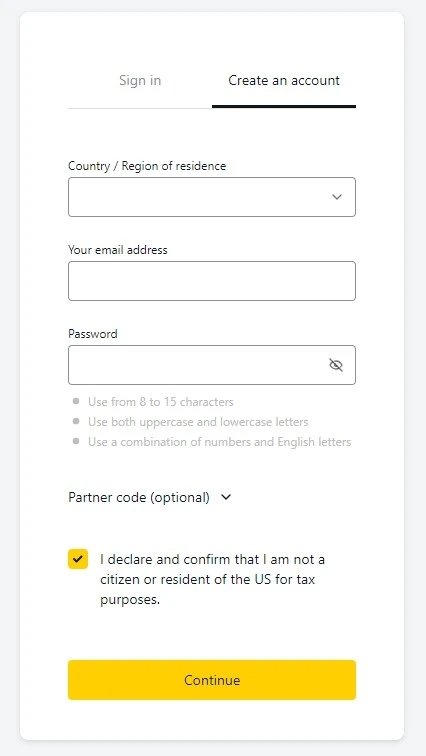

You must do the following actions in order to make a minimum deposit with Exness:

- Log in to Your Personal Area: Access your Exness Personal Area on the broker’s website using your account credentials.

- Navigate to the Deposit Section: Once logged in, locate and select the “Deposit” section to initiate the funding process.

- Choose Your Payment Method: Exness provides a diverse range of payment methods, each with its own minimum and maximum deposit amounts, processing times, and potential fees. Review the available options and select the one that best suits your preferences and location.

- Select Your Trading Account: Indicate the specific trading account you wish to fund or create a new account if needed.

- Enter Deposit Details: Specify the amount and currency for your deposit. If applicable, you’ll be presented with the current exchange rate for your transaction.

- Confirm and Complete the Transaction: After reviewing the deposit summary, confirm the transaction details. Follow the instructions provided by your chosen payment method to complete the deposit process securely.

- Receive Confirmation: Once your deposit is successfully processed, Exness will send you a confirmation email, ensuring you have a record of the transaction.