Leverage Offered by Exness

Synthetic indices are not available for trading on Exness. These indices are simulated markets that track price movements without being tied to real-world assets, often popular among traders looking for a constant, predictable trading environment. Exness focuses on offering access to real markets, including forex, commodities, cryptocurrencies, stocks, and indices. If you’re interested in trading synthetic indices, you may need to look at platforms that specifically provide these instruments. However, Exness’s extensive range of tradable assets ensures that traders have diverse options to meet their market needs.

Leverage Trading Concept

Trading leverage is the facility given to a trader to operate a larger amount in the market by using all or a smaller portion of one’s own trading capital. This is a sort of loan provided by the broker to the trader where one can have more significant exposure to the market without actually investing the entire amount. This amplifies potential gains, but at the same time, it means that any losses will also be higher, so leverage can be a double-edged sword.

How Leverage Works in Forex and CFD Markets

One of the key concepts to understand when trading foreign exchange and CFDs is leverage. Leverage allows traders to open a position that is many times larger than the deposit made by them. For example, with 1:100 leverage, it takes only $100 to have control over a $10,000 trade. The ability to leverage this much in trades enables one to make potential profits even when the price movement is relatively small. This is because of leverage: gains and losses are multiplied, and even minor adverse movements could lead to huge losses. Brokers have set varying leverage limits according to the nature of the asset, account type, and Exness regulations. These variations provide a range within which traders can choose an appropriate level, one that best fits their style of trading and risk tolerance.

Range of Leverage Available on Exness

Exness provides a number of options for choosing leverage, oriented for working with absolutely different trading tasks and levels of experience. The maximum level of leverage is as high as 1:2000. Such highly leveraged positions allow traders to hold positions whose value is many times greater than the capital they put up. Maximum leverage differs greatly among different account types and trading instruments, which enables traders to adjust their acceptable risk and market exposure with high precision.

Here’s a quick overview of leverage options by Exness account type and instrument:

| Account Type | Forex Leverage | Commodities Leverage | Indices Leverage |

| Standard | Up to 1:2000 | Up to 1:100 | Up to 1:100 |

| Raw Spread | Up to 1:2000 | Up to 1:100 | Up to 1:100 |

| Zero | Up to 1:2000 | Up to 1:100 | Up to 1:100 |

| Pro | Up to 1:2000 | Up to 1:100 | Up to 1:100 |

These leverage options give traders flexibility in managing both their trading style and risk tolerance on Exness.

How to Choose the Optimal Leverage

It depends on your experience in trading, your risk tolerance, and market conditions. It will be prudent for beginners to start with lower leverage not to be overexposed and learn about the issue of risk management. Using an Exness demo account can be an excellent way to practice this, as it allows you to test different leverage levels in a risk-free environment. The lower the leverage, for instance 1:10 or 1:20, the less is the risk of big losses, and it is easier to resist market fluctuations. Higher leverage might be used only by more advanced traders, when one has an evident strategy and knows how to justify the potentially arising risks; higher leverage can amplify both gains and losses.

Also, consider choosing leverage with respect to your trading strategy: for instance, very short-term traders, like scalpers, use higher leverage, since they plan on small price movements yielding the most dramatic effect. Longer-term traders will use lower leverage to keep positions open longer with less vulnerability to unexpected price changes. It is important to evaluate and understand your goals about trading and comfort with risk to decide on an optimal amount of leverage which will meet both your financial and trading goals.

Risks of High Leverage

Such high leverage-for instance, 1:2000-could multiply both your gains and losses, hence being like a sword with two edges. On one hand, the availability of high leverage allows traders to open and control huge positions with small deposits, while on the other, this could also mean that even minor market fluctuations might bring huge losses. For instance, with 1:2000 leverage, when the price drops as low as 0.5% on your $1,000 position, this may wipe out nearly all your account balance if not appropriately managed.

This means that, high leverage requires close monitoring and good risk management; stops can be placed to limit losses, as well as not over-leveraging one’s account. In such a way, traders will be better protected while using the opportunity for increasing their trading strategy with leverage and without exposing themselves to an unbearable risk.

Impact of Leverage on Margin and Profit

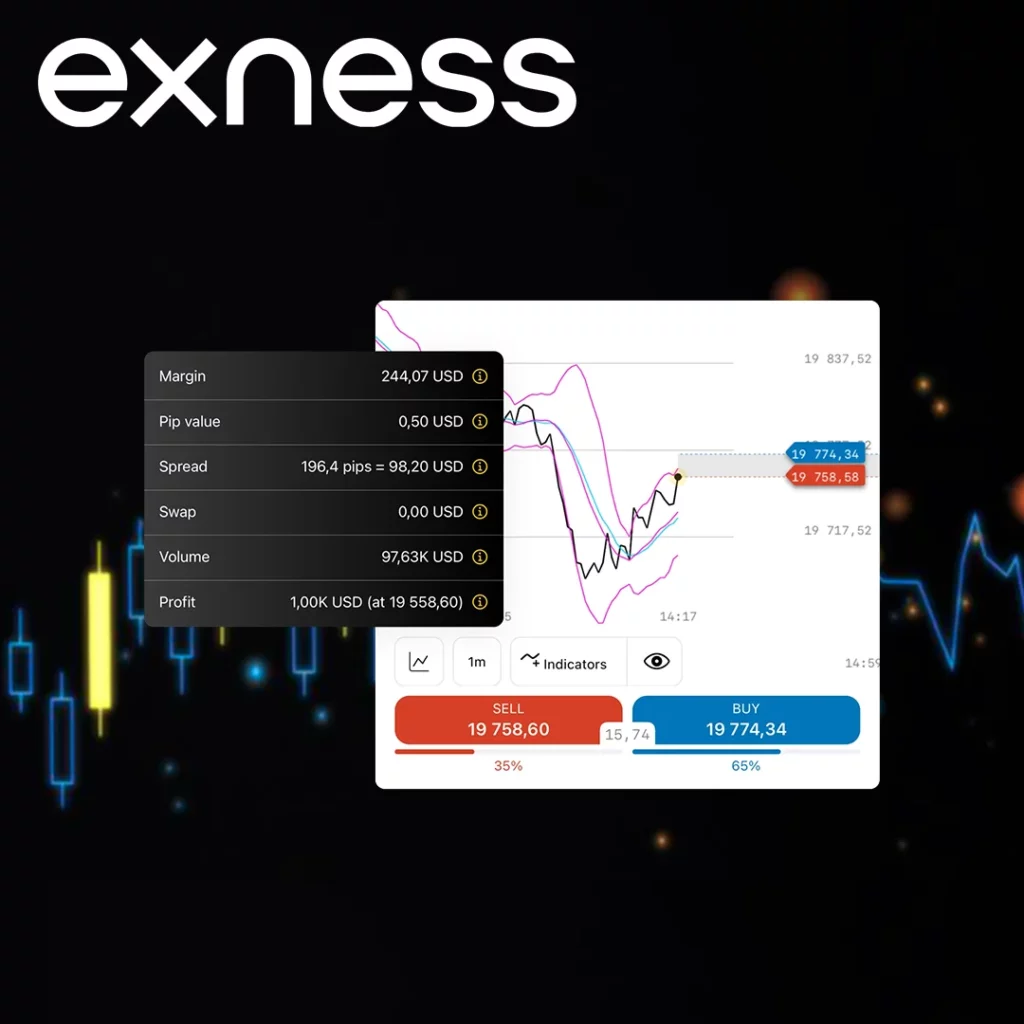

Leverage affects both the margin needed to open trades and the potential profit. Higher leverage requires less margin, which allows you to control positions of higher value with less capital. How leverage affects trading with Exness:

- Lower Margin Requirement: Higher leverage reduces the initial money needed.

- Increased Profit Potential: Gains can be higher due to larger position sizes.

- Higher Risk: Losses are magnified if the market moves against you.

For example, with 1:100 leverage, a $10,000 position requires just $100. If the position rises by 1%, you gain $100. However, a 1% drop could also mean a $100 loss, showing how leverage impacts both profit and risk in trading.

Frequently Asked Questions

What is the maximum leverage Exness offers?

Exness offers leverage up to an impressive 1:2000 or even unlimited in certain regions, depending on account type, trading instrument, and client classification.

How does Exness calculate margin with different leverage?

Exness calculates the margin based on the leverage selected, the trading instrument and the trade size. Higher leverage reduces the margin required, allowing traders to control larger positions. For an easy calculation, you can use the Exness calculator.

Is high leverage suitable for beginners?

High leverage is generally not recommended for beginners due to the increased risk. New traders often benefit from using lower leverage until they gain experience managing risk.

Can I change my leverage setting on Exness?

Yes, you can adjust your leverage setting in the Exness Personal Area. The available leverage options depend on your account type and chosen trading instrument.

How does Exness handle margin calls with high leverage?

Exness issues a margin call when your margin level drops below a specified threshold, prompting action to maintain your positions. If levels fall further, Exness may automatically close positions to prevent further losses.y usually follows predictability and stability. This is a strategy whereby one identifies the low volatility periods and then starts entering trades at the beginning of a breakout. They could make use of indicators such as Bollinger Bands or ATR to anticipate when volatility may expand, enabling them to enter trades at the exact time when price action starts blowing strongly in one direction.

Explore our latest posts to level up your trading experience.

- Changing IB in ExnessWhat is an IB (Introducing Broker) in Exness? An Exness Introducing Broker is a partner that refers new traders to the firm. They help clients open Exness account, introduce the basics of trading, and support… Read More »Changing IB in Exness

- Leverage Offered by ExnessLeverage Trading Concept Trading leverage is the facility given to a trader to operate a larger amount in the market by using all or a smaller portion of one’s own trading capital. This is a… Read More »Leverage Offered by Exness

- How to Use Exness Trading Signals?Benefits of Using Trading Signals Trading signals on Exness save time but also enable traders to act more strategically by using professional analysis. These signals quite often use indications of technical and trend ones of… Read More »How to Use Exness Trading Signals?

Feel free to peruse all our posts about online trading for a comprehensive experience.