What Is NAS100 on Exness

NAS100 by Exness is a tradable instrument representative of the dynamics of the NASDAQ-100 index, which is the top 100 non-financial companies listed on the NASDAQ. Indeed, the NAS100 is mostly famous for its inclusion of technology giants like Apple, Microsoft, and Google. This, therefore, provides exposure to the American tech sector for traders. Exness provides NAS100 with competitive spreads, flexible leverage, and round-the-clock trading. This makes it appealing to both young and inexperienced, and established traders looking to take advantage of some of the volatility and growth potential of these household-name U.S. companies, especially those in the technology and consumer sectors.

Definition of the NAS100 Index

The NAS100 Index, popularly known as the Nasdaq 100, is a stock market index composed of 100 non-financial securities from among the top listings on the Nasdaq stock exchange. The index hosts many of the leading technology, retail, healthcare, and telecommunications companies, making it an extremely representative index for the Technology and Growth sectors. This index includes companies like Apple, Microsoft, and Amazon, and serves as an indicator to investors about the performance of some of the biggest U.S. companies in the market.

If the technology stocks are performing well, then it always ensures a high NAS100 Index that reflects strength in the overall sector. When those firms have setbacks, this index may fall. The NAS100 is generally used as an indicator of health in heavy technology sectors and thus traded as one way of trading trends in United States’ technology and growth companies.

How NAS100 is Represented on Exness

The NAS100 on Exness is available under the market symbol “USTEC.” It is an interesting index that gives one an opportunity to follow the performance of and perform trading on the top 100 non-financial stocks, mostly technology companies, listed under NASDAQ.

NAS100 Symbol and Contract Details on Exness

NAS100 is available on Exness under the market symbol “USTEC” and offers different kinds of flexible conditions to trade. Some key details in the contract specification include but are not limited to:

- Competitive spreads

- High leverage options

- Multiple lot sizes to suit various trading strategies

Trading Hours and Account Types

The NAS100 index is available on Exness during U.S. market hours, which usually falls on Monday to Friday and coincides with the operational times of the NASDAQ. It allows traders to capture the market movement during high-activity hours in the US.

Exness supports the following account types for NAS100:

- Standard Account – Ideal for beginners with low spreads and no commission.

- Raw Spread Account – Offers tighter spreads with a small commission, suitable for experienced traders.

- Zero Account – Provides zero spreads on major instruments with a commission, ideal for precise cost management.

These Exness account options provide flexibility to match different trading goals and experience levels.

Features of Trading NAS100 on Exness

Exness offers several features for NAS100 trading, which is convenient and open to various trading strategies. Among these features are: high leverage options, flexible margin requirements, and multi-platform compatibility. Traders get competitive spreads, straightforward, user-friendly experience across all devices.

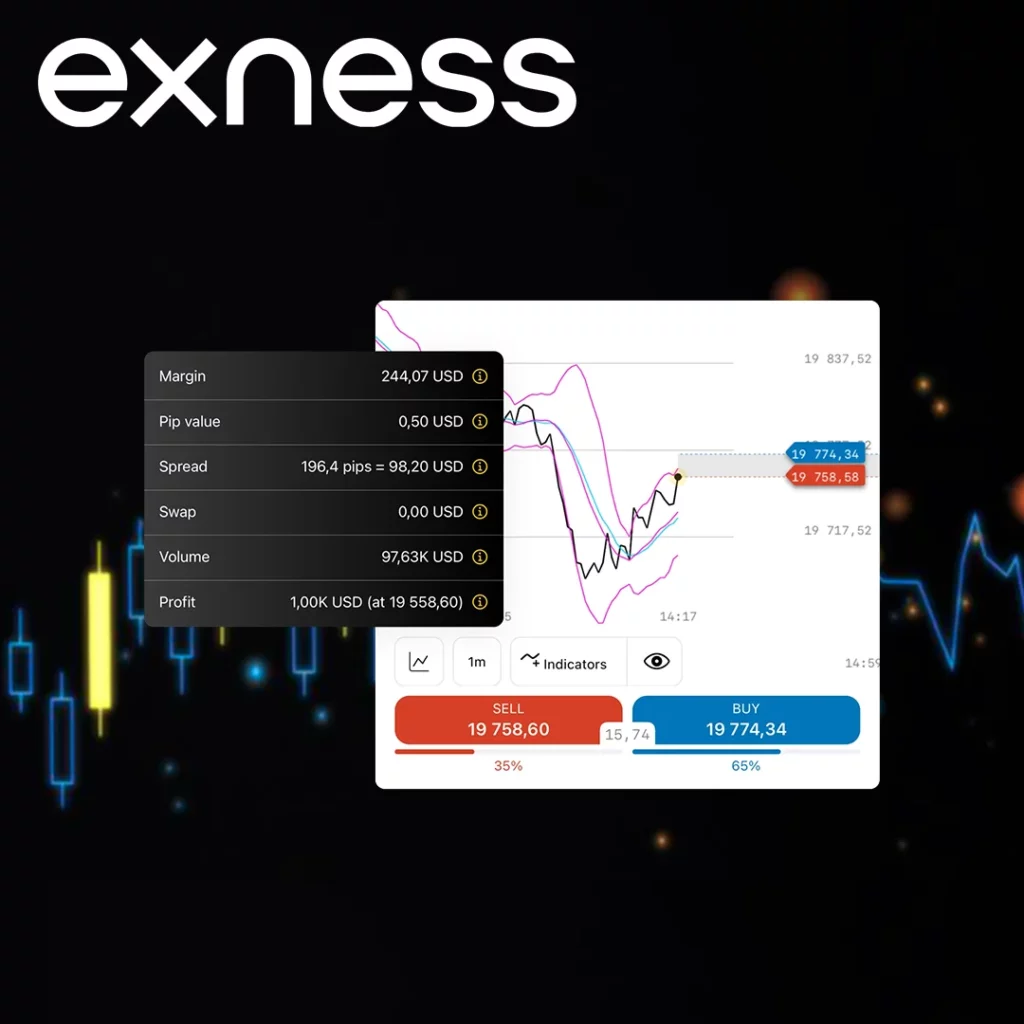

Leverage and Margin

Exness offers very high leverage for NAS100, enabling traders to maximize their potential gains with minimal capital. Having options for higher leverage gives traders flexibility, but higher leverage also means a need for more cautious risk management. Depending on the applied leverage, margin requirements change accordingly to help fit position size to individual risk levels.

Compatibility with Platforms

NAS100 can be accessed via the Exness MT4, MT5, and Exness Web Terminal; therefore, trading can be executed either on desktop or mobile. Compatibility of this account means that traders are provided with real-time data, interactive analytical tools, and a great opportunity to trade at any time and from any place.

Advantages and Risks of Trading NAS100

The aspect of trading NAS100 at Exness offers both great opportunities and challenges. The most plausible reason could be the fact that the majority of buyers seek high-tech firms with growth prospects. Understanding its benefits and risks can help achieve a perfect balance in trade.

Benefits of Trading NAS100

Volatile and liquid, the NAS100 consists of technology stocks that make it highly appealing to those traders looking to see quick movements and large opportunities. With the index, you get exposure to the cream of U.S. tech giants, thus giving traders a chance to participate in the growth of leading companies without the need to invest in individual stocks. What is more, Exness provides high leverage on NAS100, meaning a potential return is increased with less capital involved.

Risks of Trading NAS100

While leverage can increase potential profits, it also enhances potential losses. Therefore, risk management must be exercised with extreme caution. Wild swings in NAS100 might occur due to the volatility of this index and might present a risk to traders used to more stable volatile assets. Being a technology-heavy index, NAS100 will continue to remain extremely sensitive to general economic changes and news on the whole technology sector, often creating unpredictable market movements.

Comparison with Other Indices on Exness

Exness offers multiple indices, each with unique characteristics. Comparing NAS100 with other major indices like the S&P 500 and Dow Jones helps traders choose the best fit for their trading style and goals.

NAS100 vs. S&P 500

NAS100 and S&P 500 offer different exposures and trading experiences. NAS100 is tech-focused, including the top 100 non-financial NASDAQ companies, while the S&P 500 represents a wider range of 500 large U.S. companies across multiple sectors.

- Sector Focus: NAS100 is tech-heavy, while the S&P 500 is diversified.

- Volatility: NAS100 generally experiences higher volatility.

- Growth Potential: NAS100 offers exposure to high-growth tech stocks.

Traders who want balanced risk may prefer the S&P 500 for its sector diversity, while NAS100 attracts those seeking dynamic tech sector opportunities.

NAS100 vs. Dow Jones

NAS100 and the Dow Jones (DJIA) differ significantly in composition and risk profile. The Dow Jones tracks 30 prominent U.S. companies, primarily from traditional industries, whereas NAS100 includes innovative tech firms.

- Company Count: NAS100 has 100 stocks; DJIA has 30.

- Sector Focus: NAS100 is tech-oriented, DJIA spans various sectors.

- Volatility: NAS100 tends to be more volatile.

For traders seeking tech exposure and higher growth, NAS100 is ideal. The Dow suits those interested in stability and traditional blue-chip stocks, providing a different kind of market exposure.

Strategies for Trading NAS100

Setting up a strategy for NAS100 trading involves balancing its volatility and growth potential. Succinctly, most successful approaches blend technical and fundamental analysis to capture both short-term movements and long-term trends; this, of course, considering how sensitive NAS100 is to changes within the tech market and economic data releases.

Technical Analysis for NAS100

Technical analysis on NAS100 focuses on patterns and indicators to predict price movements. Common tools include:

- Moving Averages: Identifies trends by smoothing price data.

- Relative Strength Index (RSI): Shows overbought or oversold conditions.

- Support and Resistance Levels: Helps spot potential entry and exit points.

Using these tools allows traders to gauge NAS100’s market direction and take advantage of its frequent price swings, especially in times of high tech-sector volatility.

Fundamental Analysis for NAS100

Fundamental analysis for NAS100 centers on evaluating economic data and company performance. Key factors include:

- Tech Company Earnings Reports: Major earnings releases can significantly impact NAS100.

- Economic Indicators: Data like GDP and interest rates affect investor sentiment.

- Sector News: Regulatory changes or tech advancements can influence prices.

By staying informed on these fundamentals, traders can anticipate NAS100’s responses to broader economic shifts and developments within the tech industry.

Frequently Asked Questions about NAS100 on Exness

What are the Minimum Requirements for Trading NAS100?

To trade NAS100, traders need a verified Exness account with sufficient funds to meet margin requirements. Leverage options vary, so ensuring adequate capital and selecting suitable leverage are essential for managing position size effectively.

How is NAS100’s Performance Affected by Market News?

NAS100, being a tech-focused index, is sensitive to economic data, interest rate changes, and news about major tech companies. Positive earnings or industry growth can boost NAS100, while regulatory concerns or economic downturns can lead to declines.

What trading hours are available for NAS100 on Exness?

Indices trading on Exness is available during U.S. market hours (typically from 9:30 AM to 4:00 PM ET), but access to pre-market or after-hours trading may vary based on platform settings.

What leverage is offered for NAS100 trading on Exness?

Exness offers flexible leverage options for NAS100, often up to 1:200 depending on account type, allowing traders to optimize position sizes and risk management strategies.

Are there fees for trading NAS100 on Exness?

Exness may apply spreads and, for certain accounts, a commission on NAS100 trades. These costs depend on account type and trading conditions, so reviewing account details is recommended.

Can I use technical analysis tools for NAS100 trading on Exness?

Yes, Exness provides a range of technical analysis tools on MT4, MT5, and its Web Terminal, helping traders analyze NAS100 trends, support/resistance levels, and price patterns.a breakout. They could make use of indicators such as Bollinger Bands or ATR to anticipate when volatility may expand, enabling them to enter trades at the exact time when price action starts blowing strongly in one direction.

Explore our latest posts to level up your trading experience.

- Changing IB in ExnessWhat is an IB (Introducing Broker) in Exness? An Exness Introducing Broker is a partner that refers new traders to the firm. They help clients open Exness account, introduce the basics of trading, and support… Read More »Changing IB in Exness

- Leverage Offered by ExnessLeverage Trading Concept Trading leverage is the facility given to a trader to operate a larger amount in the market by using all or a smaller portion of one’s own trading capital. This is a… Read More »Leverage Offered by Exness

- How to Use Exness Trading Signals?Benefits of Using Trading Signals Trading signals on Exness save time but also enable traders to act more strategically by using professional analysis. These signals quite often use indications of technical and trend ones of… Read More »How to Use Exness Trading Signals?

Feel free to peruse all our posts about online trading for a comprehensive experience.