Crypto CFD Trading

What is Crypto Trading? Trading crypto means buying and selling digital money to make money from price changes. It’s different from normal investing. You can trade one crypto for another… Read More »Crypto CFD Trading

Explore the latest insights and strategies in trading on our Exness blog. Stay ahead of the curve and enhance your trading skills today!

What is Crypto Trading? Trading crypto means buying and selling digital money to make money from price changes. It’s different from normal investing. You can trade one crypto for another… Read More »Crypto CFD Trading

What are Indices Trading? Trading indices is about speculating on stock group price changes. Indices track stock group performance, giving traders a market health view. Instead of buying single stocks,… Read More »Indices CFD Trading

What is Forex and How Does it Work? Forex trading involves buying one currency while simultaneously selling another to speculate on price movements. Exness Forex CFDs allow traders to participate… Read More »Forex CFD Trading

What are Stocks? Stock CFDs (Contracts for Difference) allow you to trade on price movements of company shares without taking ownership. Unlike traditional stock investments where you become a shareholder,… Read More »Stocks CFD Trading

What Are Commodities Market? Commodity CFDs (Contracts for Difference) allow traders to speculate on price movements of raw materials without owning the physical assets. Instead of purchasing barrels of oil… Read More »Commodities CFD Trading

Overview of the Exness Premier Program Tiers Tier Tier Quarterly Trading Volume Key Benefits Preferred $20,000 $50 million Priority support, trading reports, special rewards Elite $50,000 $100 million Dedicated account… Read More »Premier Program

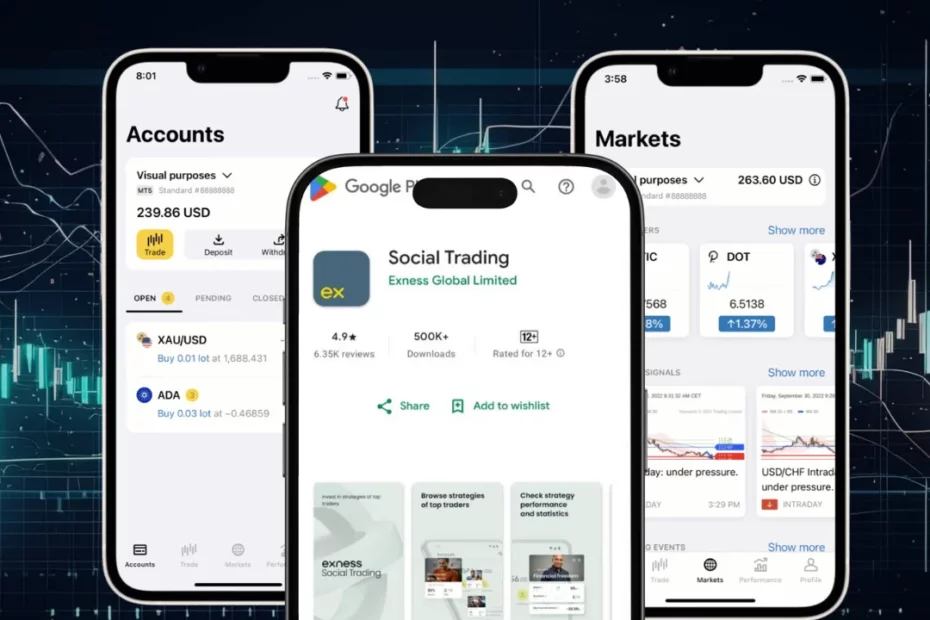

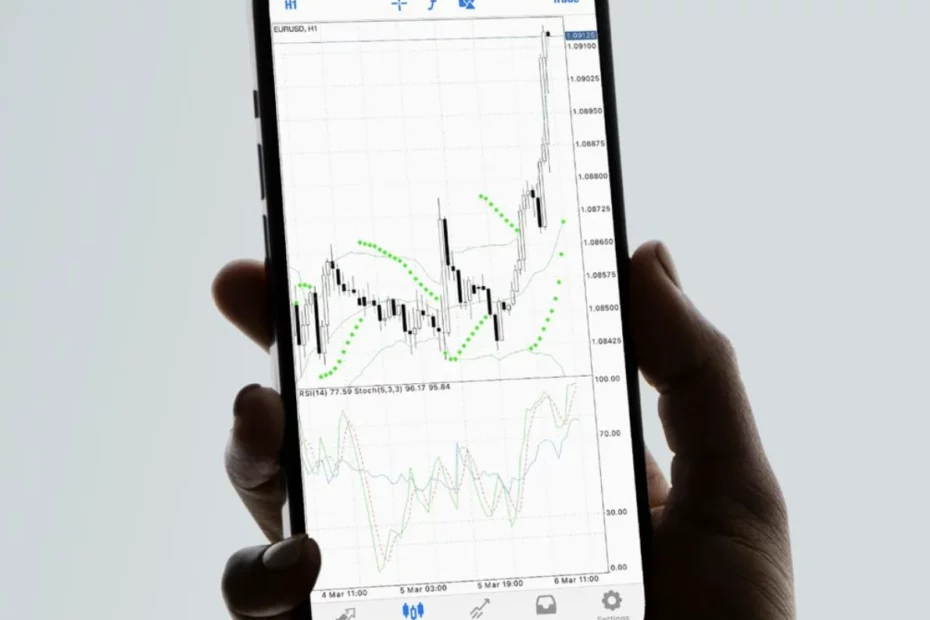

Mobile Trading with Exness MT4 App The Exness MT4 mobile app delivers the essential trading capabilities of the desktop platform in a compact, touch-optimized interface designed specifically for smartphones and… Read More »MetaTrader 4 Mobile App

Trading on Smartphone with MT5 The Exness MetaTrader 5 mobile app brings professional trading capabilities to your mobile device. Setting up a trading account is simple, and you’ll get benefits… Read More »MT5 Mobile App

The Exness trading platform provides a powerful and user-friendly interface that allows traders to access various financial markets, execute trades, and manage their accounts effectively. Whether you are a beginner… Read More »How to Use the Exness Trading Platform

Create a Strong and Unique Password A strong password is the primary defense against unauthorized access to an Exness account. Weak or simple passwords are vulnerable to being guessed or… Read More »How to Protect Your Exness Account